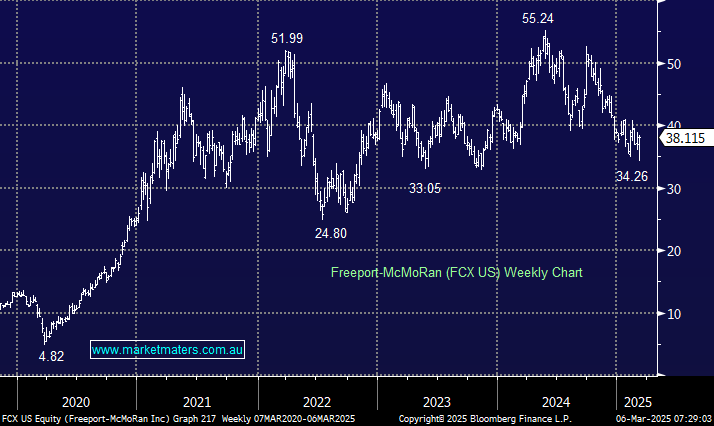

Freeport-McMoRan Inc. (FCX) US is a leading US mining company focusing heavily on copper; in the fourth quarter of 2024, copper sales contributed over 75% of the company’s total revenue. The stock has struggled over the last 6-12 months, tracking the Cu price closely but failing to embrace its recent recovery; last night’s 9.3% surge higher, its best day since 2022, could be a sign of things to come with a re rating likely if the market becomes convinced that Cu will be higher for longer, as opposed to a Trump-inspired fleeting advance.

FCX has experienced issues obtaining export permits from the Indonesian government, potentially impacting production rates and overall valuation concerns, following its strong post-COVID advance. However, these issues have more than been built into the share price, trading under $US40 and we like the risk/reward at current levels.

- We can see a test of $US50 by FCX through 2025, over 30% higher. MM is long FCX in our International Companies Portfolio.