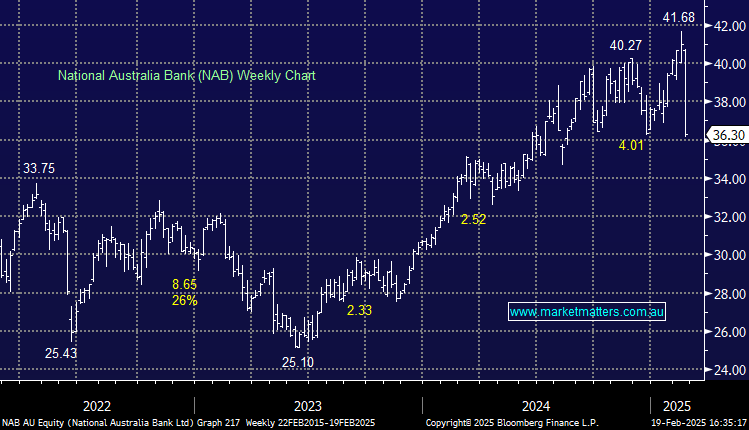

NAB –8.12%: Hit hard today on what looked to be a slight miss at their quarterly trading update;

- Revenue mildly ahead of expectations but that was driven by Markets & Treasury, which markets tend to look through. Stripping those out, revenue was a slight miss.

- 1Q25 cash earnings of $1.74bn, about ~1% below consensus.

- The bad debt charge ticked up to $267m, higher than expected, which reflects a deterioration in business banking and higher arrears in the mortgage portfolio – something we did not see in the other banks.

- Capital levels were also below expectations.

Looks to us like a combination of (slight) misses across several metrics has turned the market against NAB, and when share prices have risen so strongly in recent times void of earnings support, small chinks matter.

We’ve highlighted previously the impact of CBA pushing hard into business banking as a risk factor for NAB, and without too much granular detail, it looks to us that NAB is being more aggressive to defend market share and it’s having a (negative) impact.