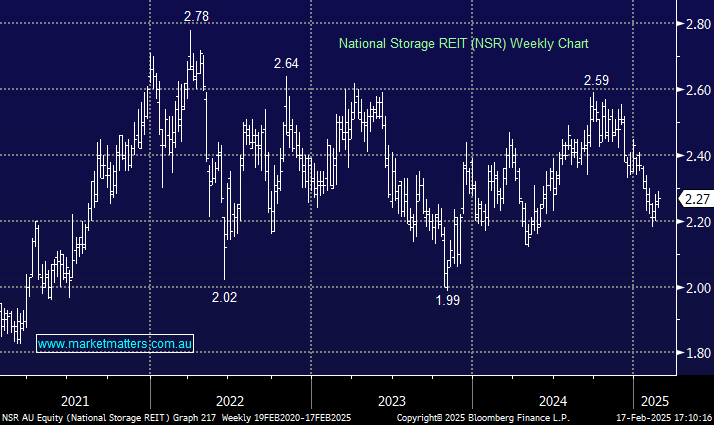

NSR has been struggling since late 2024, but last Friday’s result from rival Abacus Storage (ASK) gives us cause for optimism, having pushed the stock up more than 6% in two trading sessions. One of the key risks some investors have been worried about in Australian self-storage has been the potential for what is known as a revPAM growth reduction, which is revenue per available metre as a result of tight momentary conditions, and a struggling consumer.

However, Abacus Storage King’s results highlighted improving occupancy (up to 91%) and continued rental rate growth (up 4.4% YoY) resulting in revPAM growth of 5.4%. That is a good number and is a supportive readthrough for NSR ahead of their results on the 21st February, particularly given NSR now trade at a ~12% discount to the value of assets (NTA), which we expect to improve.

NSR faces the music this Friday, but we see a cushion for the share price in its prevailing discount to NTA , plus its sustainable 5% unfranked yield will be more highly sort after if rates fall. Remember, the self-storage operator was at the centre of a three-way takeover tussle in 2020; potential suitors may be watching the recent underperformance closely.

- We like the risk/reward toward NSR into Friday’s result: MM is long NSR in its Active Growth Portfolio and Active Income Portfolios.