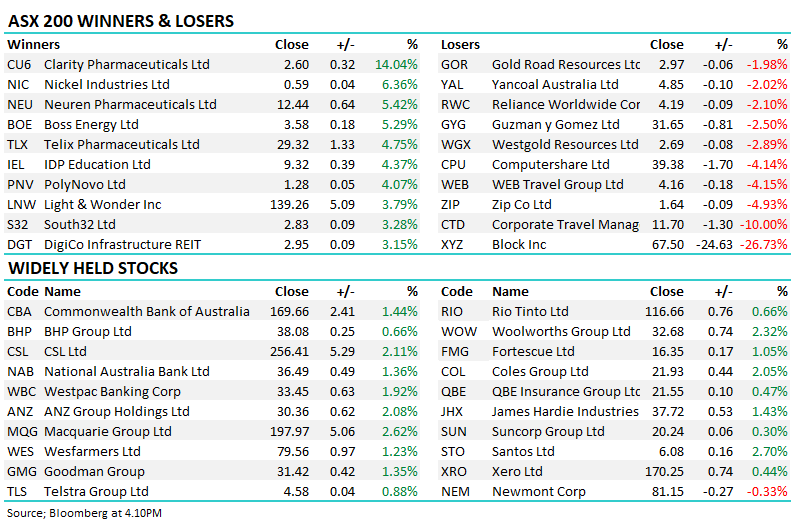

After yesterday’s surge by CBA and the Big Four Banks, it was hard to avoid revisiting one of the majors. Picking a top on any market breaking out to new highs is fraught with danger, but in the case of WBC, its last two legs on the upside were ~$8 before we saw a period of consolidation; if the rhythm continues in 2025, $38 is on the cards, or 8-10% higher. While momentum buying has been pushing the banks higher, a sustainable ~4.6% fully franked yield, forecast over the next 12-months, is still better than most term deposits, especially with rate cuts on the cards in 2025.

- We wouldn’t be fading the strength in WBC yet; it is extended and rich, but it doesn’t feel like “panic buying.”