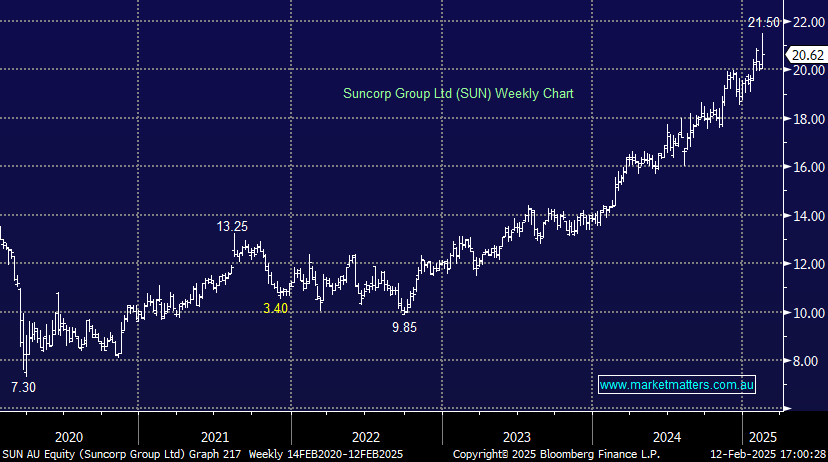

SUN +1.33%: on first pass of the numbers, it looked a big beat from the insurer, earnings ~11% ahead of consensus however that was driven by a better claims experience, so of lower quality. The sale of their banking unit also provided a tailwind to numbers, and we got some clarity around the size and structure of capital management associated with the sale to ANZ.

- Cash profit of $860 million up +30% YoY and if we include the sale of the banking unit, that number jumped to $1.1bn

- Interim dividend per share $0.41

- Underlying insurance trading ratio 11.8%

$4.1 billion of net proceeds from the sale of Suncorp Bank will be returned to shareholders through a $3.8 billion capital return and $300m fully franked special dividend, equating to $3.00 and $0.22 per share respectively. They also said they remain in a robust capital position with capacity for further capital management initiatives, most likely on-market buy-backs.

A good result from SUN, and while the market was too upbeat on the open, they are continuing to perform operationally and detail around capital returns was important, and inline with market expectations.

- SUN will trade ex the $3 capital return and ex the ordinary + special dividend on the 17th Feb.