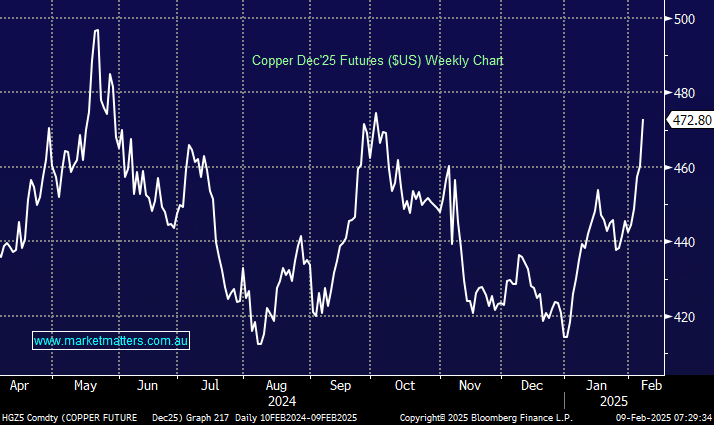

Copper is trading in “Contango”, the opposite of Fe, which supports Cu producers. On Friday, March’25, Copper was trading at $US4.59/lb compared to $US4.76/lb in March ’26, a ~4% premium. We all know about the global electrification story; one MM is a firm believer in, e.g. India’s demand for the industrial metal is set to surge five-fold over the next 25 years, according to BHP. They may be talking their own book, but limited future supply will increase prices, and they are backing this view with significant investment $$.

- We are initially looking for another test of $US5.00/lb over the coming months, or ~5% higher.