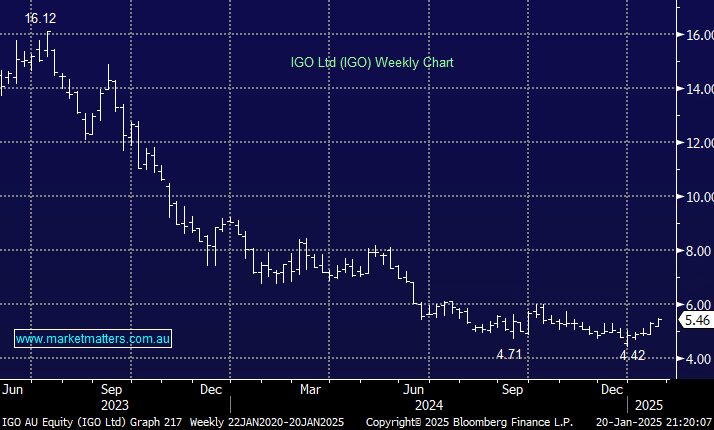

IGO initially slipped lower on Monday after announcing it would post a loss from its West Australian lithium (Li) processing facility as the miner struggles to find buyers for its product like many of its peers in the current weak market. However, the stock bounced ~6% from its intra-day low to finish the day up +2.6%, a solid performance considering the news. IGO has plunged over recent years after paying a crazy price for nickel miner Western Areas in 2022, only to see its other revenue stream, Li, fall by over 80%, a painful one-two combination. However, at MM, we are conscious that lows are formed when things look their worst, and that’s certainly the case for Li stocks.

- We believe IGO’s next ~20% move is on the upside if it can hold above yesterday’s $5.15 swing low.