WOR

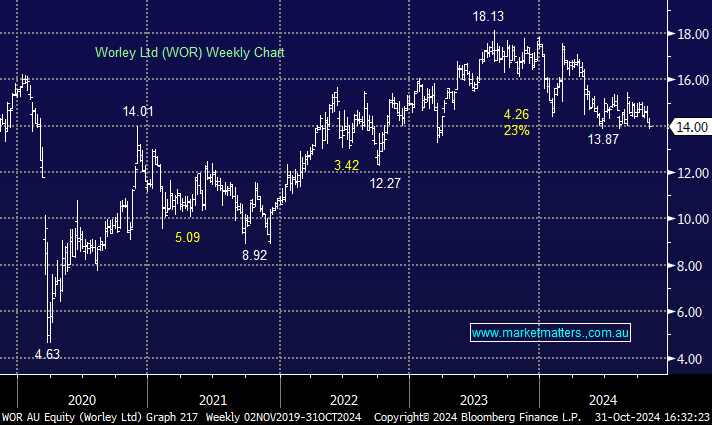

To the MM Team, My question relates to Worley. The SP has dropped 18% in the last 12 months and 5% in the October. I note that most analysts have the stock as a buy with a target price of around $17-18 (25% possible upside). What has caused the loss in confidence in WOR? Is it the high PE or questions about future growth? I would like to hear your latest views. And, if you were not a holder would you consider buying in at these levels? Keep up the great work, Charles