We have avoided TPG for well over two years, and although the outlook has improved, it is unlikely to be on our Hitlist in 2024. TPG, like TLS, is planning job cuts, although not of the same magnitude, as the telco group, which is carrying more than $4 billion in debt, endeavours to reduce its expenses. TPG’s latest net profit came down 40% YoY due to rising costs from leasing agreements and high interest rates; trimming its workforce by 2-3% will help, but not meaningfully.

TPG is trying to migrate customers away from NBN plans to fixed wireless. Still, Internet broadband subscribers fell amid more vigorous competition from Aussie Broadband and Superloop, which have been gaining market share. A portion of the decline in subscribers was due to TPG’s decision to ditch email services for all of its brands, including iiNet, making it easier for customers to switch internet providers – more email hassles for the unsuspecting Australian public.

This month, the TPG Telecom / Optus network-sharing deal got ACCC approval, providing Australians with a greater choice of mobile phone plans and faster data downloads after the competition regulator said TPG Telecom could share networks with Optus in regional areas. This is likely to see greater competition in such areas for TLS – the deal expands TPG’s coverage by about 600,000 square kilometres, reaching areas that are home to about 17% of Australia’s population.

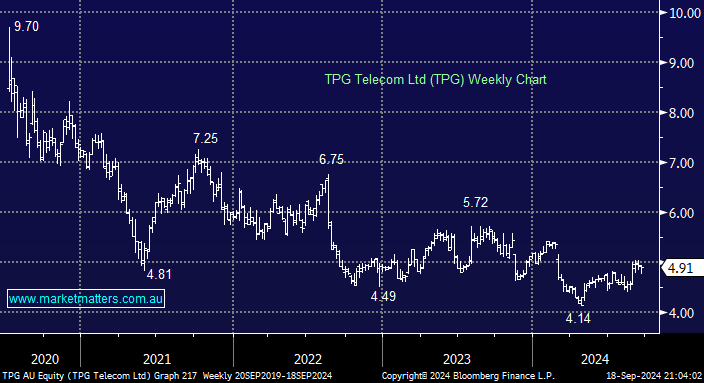

- We believe TPG has turned the corner, and a break above $5 wouldn’t surprise us as interest rates turn lower.