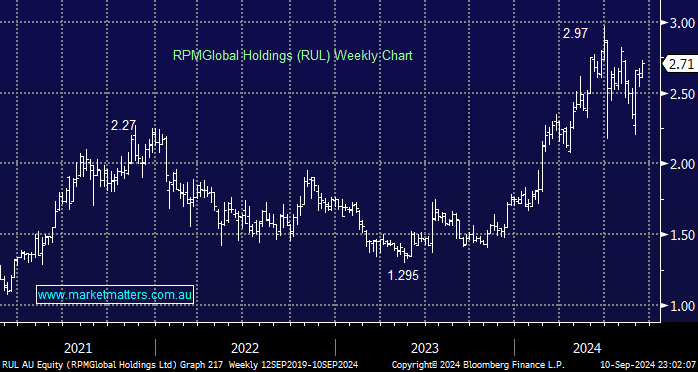

RUL is at an interesting stage in its life, often referred to as an inflexion point where the investments made over a long period start to have a meaningful impact on the operating metrics of the business, underpinning a strong improvement in operating leverage, profitability and free cash flow, all the things that make software businesses great investments if they work.

Taking a step back, this $600m company develops and sells enterprise mining software solutions, covering all aspects from mine planning to execution. They used to sell this software under licence for a large upfront fee and then smaller maintenance fees each year. They flipped the model in 2017, turning it into an annual subscription-based service which caused short-term pain on revenues, but the change is now bearing fruit with revenues reoccurring in nature, making them stickier and a lot more predictable over time, while compounding does the rest.

The same is true in a subscription service like Market Matters. Some business models in our space sell higher cost, longer-dated subscriptions (much like licence fees), which is a quick sugar hit to revenues initially, however, there are many examples where businesses fail over time using this model. Each year they start from scratch again and try and find new customers to sell to. It’s a flawed model, but a hard one to change.

- It took around 5 years for RUL to push through the change where shorter-dated subscription revenue overtook licence sales, but they are now over the hump, and it creates an exciting platform for growth over the coming years.

In FY24, RUL sold $77m of subscriptions for the full year, beating the $70m in FY23. About half of new sales in the 2H were contracted for at least eight years, and both contract size and length is increasing. In FY25, it is expected that total revenue will top $120m with earnings (EBITDA) nearing $20m, up 20% y/y, In FY26, that growth rate is expected to leap again to ~30%, which highlights the power of the model as it scales.

We are bullish on the broader mining space over the coming years, with the energy transition driving huge investment at a time when running mine operations as efficiently and sustainably as possible becomes increasingly important – RUL’s suite of solutions helps mining companies do this.

- We have RUL residing on the Hitlist for the Emerging Companies Portfolio