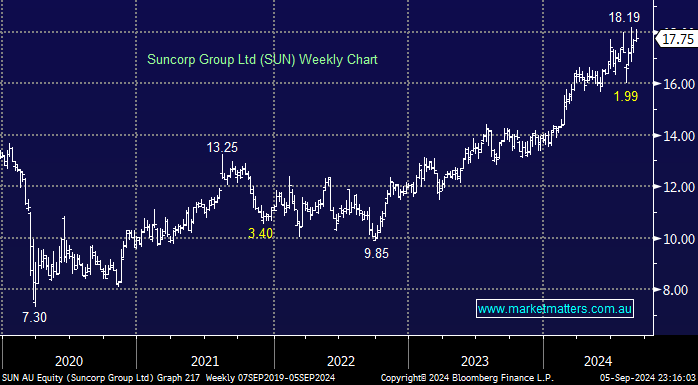

We felt that SUN delivered an okay result in August, which has been reflected in the share price. Plus, some investors have probably already got their eyes set on the likely capital return post the bank sale in early 2025. SUN is popular with the analysts, with 4 Holds and 8 Buys, which may provide an opportunity into Christmas if we see another market dip. Home and motor repricing looks set to remain firm, and I’m sure all members feel the difference here, but while we anticipate further margin expansion into FY25, we’re not keen to chase the stock above $18. On current numbers, we estimate SUN’s general insurance business is trading at a ~12% discount to IAG, a differential likely to contract over time, making SUN our preferred option of the two.

- We expect a combined capital return and a smaller special fully franked dividend of ~$3. Together with next year’s ordinary dividends, this represents around 22% of the current market cap.

- We are keen buyers of SUN back around its August lows as the insurer forges ahead after the sale of its banking division.