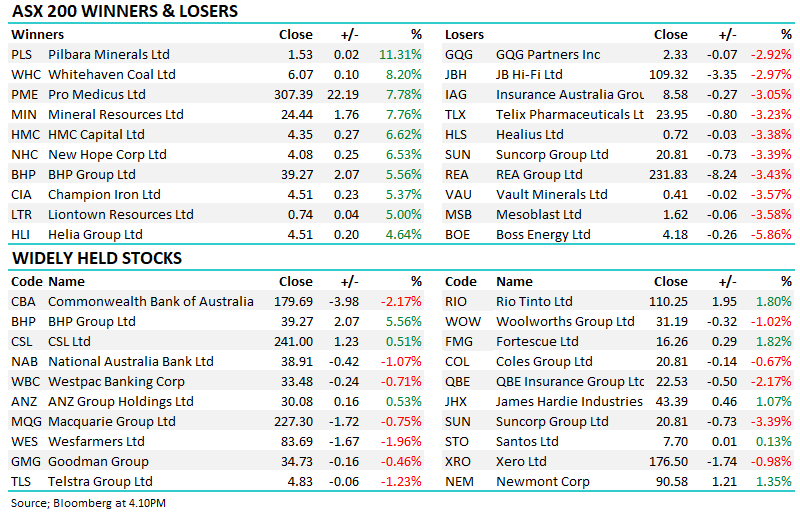

IGO is the lowest-cost lithium (Li) producer on the ASX, but parts of its August report were on the softer side and they certainly dropped the ball with their push into Nickel at the wrong time. Fortunately for IGO, they have a net cash position of $468mn on their balance sheet which does provide more insulation relative to companies carrying a higher debt burden such as Mineral Resources (MIN), but it remains all about the Li price. IGO has already cut production this year, and with lower production, unit costs increase therefore impacting the financial metrics of their operation.

When Li does finally turn, we have little doubt IGO and others will rally hard and fast, however from what level is the key?

- We cannot see any triggers to justify buying IGO at this stage of the cycle.