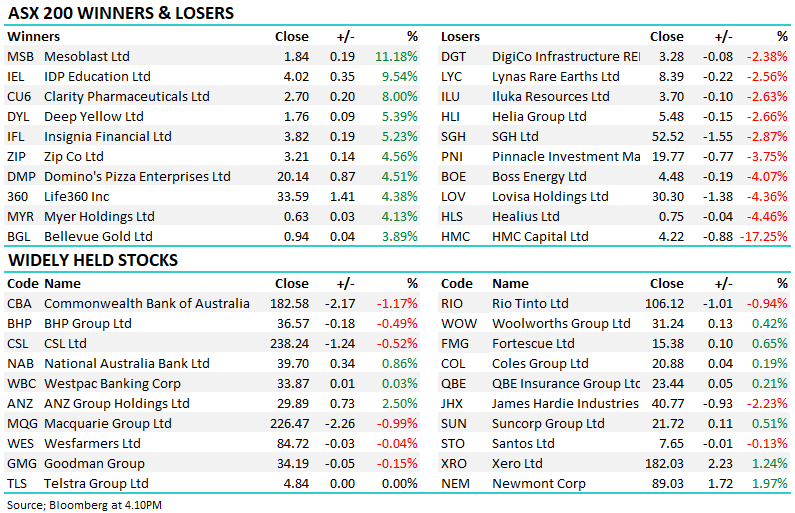

It’s not often you’ll see an ASX200 stock endure a 99% drop in profits, but that’s precisely what happened to IGO on Thursday, which suffered from collapsing lithium and nickel prices, rising costs and further chunky write-downs.

- Total revenue down 18% to $841mn.

- Underlying earnings (EBITDA) down 71% to $581 million and profit (NPAT) down 99% to $2.8mn.

- Net cash balance of $468mn, up 13% from FY23.

- A 26c fully franked dividend was announced.

CEO Ivan Vella remained optimistic in today’s challenging market, as he must while alluding to a “new strategic direction.” The critical minerals provider has just managed to profit in the current extremely tough environment. Catching this falling knife is scary, but we believe it will be higher in the coming years. The million-dollar question is how far it can fall first; we never imagined it would be sub $6 when we started selling IGO back in 2022, around $16!