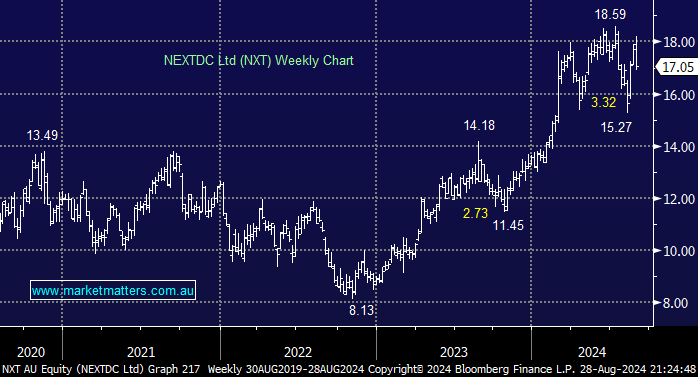

Data centre operator NXT slipped -4.3% on Wednesday after its guidance for FY 2025 overshadowed a solid FY24 performance. However, like fellow data centre play Goodman Group (GMG), NXT tends to “under promise and over deliver”.

- Total revenue was up +12% to $404.3

- EBITDA was up 5% to $204.3mn, ahead of $196.9mn consensus guidance.

- Capital expenditure up $1,002.6mn, +44% yoy and above expectations.

- For FY 2025, mgt. guided to net revenue of $340-350mn, with growth of 10.4% to 13.7%, slightly below estimates.

We like NXT as a quality stock to gain exposure to the data centre revolution required to cope with the AI boom. Any further weakness following the softer-than-expected fiscal 2025 guidance is a buying opportunity. The macro backdrop is very supportive & NXT will remain on our hitlist for the Active Growth Portfolio.

In the short term, the markets’ interpretation of Nvidia’s result over the coming days will likely inject some volatility into NXT’s share price, with the initial knee jerk lower likely to apply some pressure on NXT today.

- We are conscious of NXT’s popularity with 15 buys and one lone sell, indicating a potentially crowded trade.