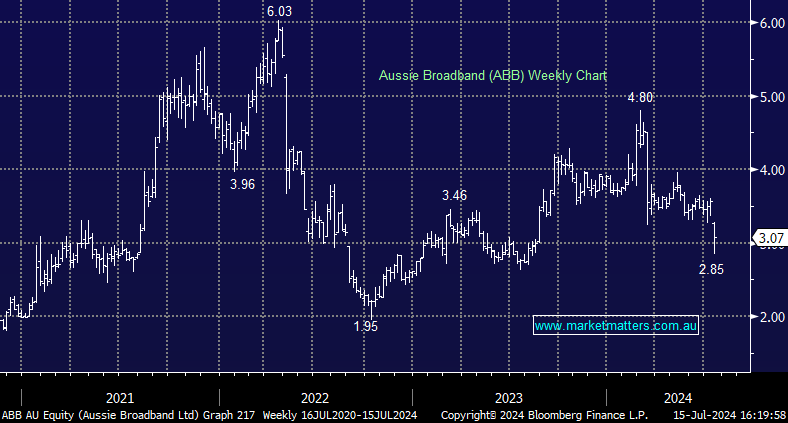

ABB -14.01%: The telco was hit hard today, down around 20% at their lows before partially recovering, after they provided FY25 guidance that was below consensus, despite saying they’d hit the high end of their recently upgraded FY24 numbers. They also launched a challenger brand called ‘Buddy Telco’ – https://www.buddytelco.com.au/ to compete in a more automated, lower cost area of the market against the likes of Superloop (SLC), and this will cost them ~$10m to launch and promote. Markets are forward-looking so FY25 guidance for $135m-$145m in EBITDA (excluding challenger brand), compares to consensus of ~$150m, so inclusive of Buddy Telco, that’s a $20m/13% miss. It is worth noting that ABB typically guides conservatively, so we keep that in mind, plus they outlined some big ambitions to grow subs by +100k within 3 years (against the current 684k), so they are talking a big game, but the guidance was underwhelming.

- Ultimately, a ~20% pullback was excessive, the stock deserves to be down ~10% in MM’s view, and we think the challenger brand is a good a move that will drive future growth.