Should I take profit on Aussie Broadband (ABB)?

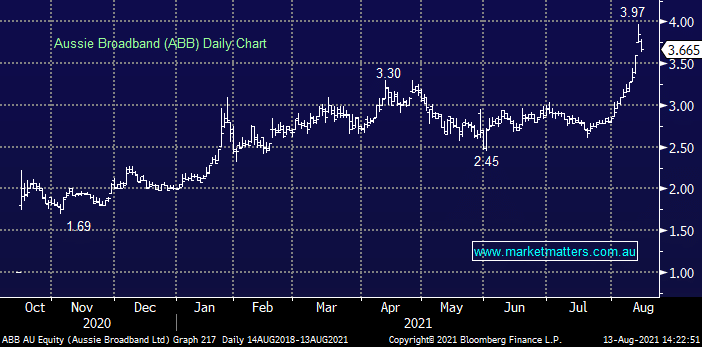

Glad I took up the two year offer MM team! I've been interested in Aussie Broadband (ABB) for a while and after your positive note on the business at the end of July, I bought in at $2.84. It is now more than 30% up and question is if you have a take profit target or is this one for the long haul?

Nathan