Whatever way we think about AI, data underpins it. Companies with deep levels of data are at an incredible advantage over those without, and there is no company on earth with more data than Google captured through its dominant search engine and ownership of YouTube. While the future of search engines as we know them may be in question as a result of AI, the volume of data Alphabet collects across its various platforms puts it in an unparalleled position to continue training and honing its AI models and applications. If they get it right, and there is no reason why they would not, this creates a clear advantage to enhance products and services across other areas of their business.

- If we agree that AI is a fundamental change in the world and we’re only in the initial stages of its evolution, then we must think about GOOGL as a play on this theme.

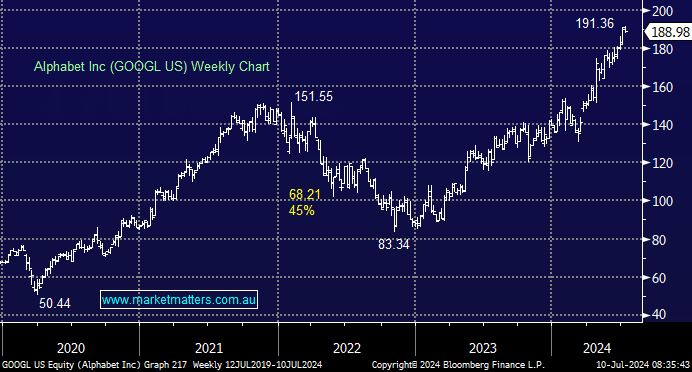

Trading at all-time highs having rallied ~60% in the past year creates a challenging risk/reward profile buying GOOGL today, however, similar to the piece we wrote on Nvidia (NVDA US) a few weeks ago (available here) we ponder the question, at what level would it be a buy for us?

GOOGL trades on a forward PE of 23x, which for context, is astonishingly only 1 PE point above Commonwealth Bank (CBA) and cheap relative to the Magnificent Seven, which as a group trades on 36x. From a longer-term perspective, GOOGL is broadly in line with its longer-term average PE of 22.4x. It’s understandable why 54 of the 66 analysts that cover the stock have it as a buy, with 12 holds and no sells, with a consensus earnings growth rate of ~17% for the next 3-years.

- It will not take a significant pullback in GOOGL for the risk/reward profile to stake up, noting that we’ve been too conservative in our approach to the stock over the past year.