This time last year MM’s Webinar: Resources into 2024 focused on the global energy transition which covered the key related commodities such as lithium, copper, and uranium – definitely worth a listen to remind ourselves of some of the huge thematics moving forward . Three of our main takeouts were as follows:

- Copper (Cu) – very bullish with a significant multi-year and decade bullish cycle coming through due to supply challenges with short-term concerns around global growth providing buying opportunities.

- Lithium (Li) – The markets proved to very wrong on the demand side here and the reality is the worlds not short of Li making it harder to forecast, although we believe the ~80% correction is maturing.

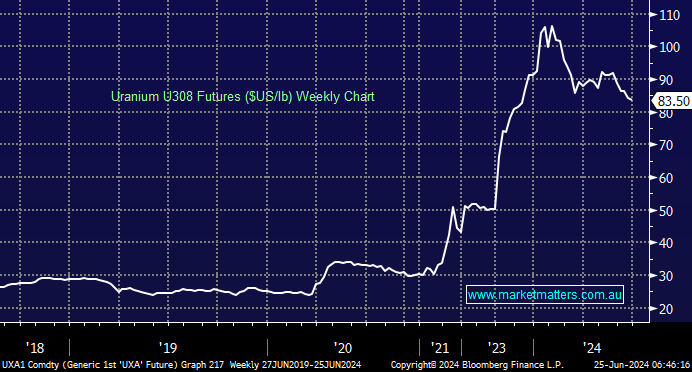

- Uranium (U) – very bullish as nuclear power regains global acceptance, we now have more nuclear power facilities under construction than since the 70s’. The supply challenges in U are on a comparative level to Cu especially with Russia supply now off the market for the foreseeable future.

We we’re on point 12-months ago which is always nice but importantly we remain very bullish towards Cu and U over the coming years and hence we are going to be ”buyers of dips” and only cautious reducers, as opposed to aggressive sellers into spikes.

The Global X Uranium ETF provides exposure to a broad range of stocks involved in uranium mining including overseas giant Cameco Corp (CCJ US) plus it holds 8% in physical U. This is a good way to play the sector for investors who want some overseas exposure and aren’t keen on stock specific risks.

- We like the risk/reward towards the URA ETF into the current pullback but wouldn’t be surprised to see a test of the $US27-28 level.

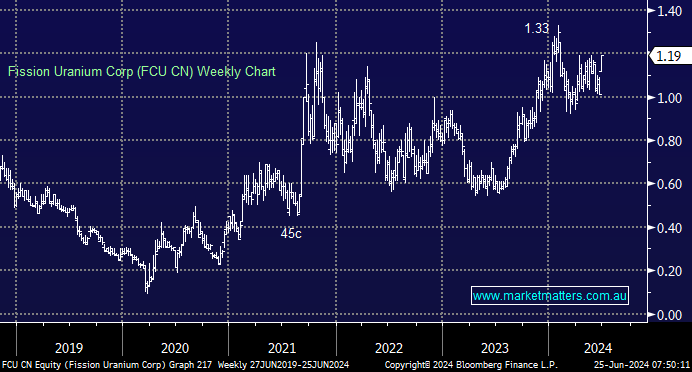

Paladin (PDN), whose market cap was just shy of $4bn on Friday have bid $921mn for Canadian-listed Fission Uranium (FCU CN) an implied price of $1.30 per share, a ~30% premium to its last trade. FCU shareholders will receive 0.1076 PDN shares for each of their FCU shares with shareholders in the Canadian company owning 24% of the combined company. Importantly the FCU board has recommended shareholders vote in favour of the deal which is targeted to close in September – we bet BHP wish things had been so easy with their attempted purchase of Anglo American (AAL LN)!

- We believe FCU shareholders will be happy with the takeover allowing them to maintain U exposure in the sector via PDN shares which will now dual list on the Toronto and Australian exchanges, with a broader asset base.

PDN’s bid for FCU heralds the return to acquisitions in the sector amid a nuclear renaissance. Russia’s invasion of Ukraine has sent the world scrambling for alternative energy sources sending the price of U soaring, especially as its regarded as a clean energy by most major countries.

- If/when Australia’s restrictive policies on uranium exploration and mining are lifted, it could deliver some huge gains for ASX uranium stocks – if Dutton moves ahead in the polls, watch this space!