Gold company Silver Lake Resources went into a trading half yesterday ahead of the implementation of their merger with fellow WA miner Red 5 (RED) this week. Silver Lake shareholders, which includes Market Matters, will be issued 3.434 RED shares for each SLR share held, currently worth $1.51/sh as at yesterday’s close price. While we think the Silver Lake board left some meat on the bone with this transaction, we view the deal as a positive and are happy shareholders of Red 5 in the Emerging Companies Portfolio for a few reasons, while we remain bullish gold medium term.

While both companies have similar FY24 production expectations, Silver Lake is expected to see declining rates over the next few years vs Red 5 is expected to increase slowly. The combined entity will also enjoy a strong balance sheet position with Red 5’s small ~$50m debt more than paid off by Silver Lake’s ~$200m net cash. This will allow for an accelerated mine plan at King of the Hills (KOTH), Red 5’s key asset, which is expected to bring forward cost savings and improve mining rates whilst also helping to fund additional drilling works across the assets.

As with any deal, there are some risks. Silver Lake is running down older mines at this stage, hoping to convert much of their reserve (i.e. potential resource) into a resource. Cost blowouts are common as mines age, and the merged entity will be looking to extract the most out of the assets while hoping to increase the mine life. Changes to the mine plan at KOTH also pose a threat, with capex brought forward to, hopefully, adjust the near-term cost rate.

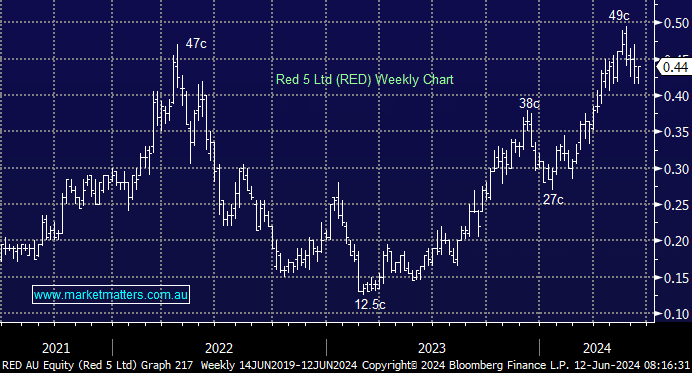

- MM is targeting 60c for the new look Red 5 (RED)