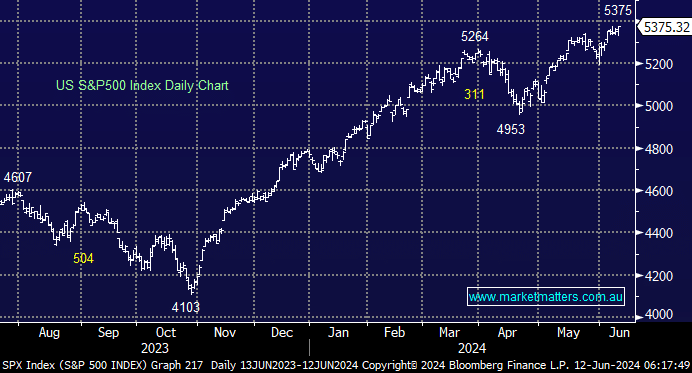

US equities closed at all-time highs last night, taking no notice of the negative leads from Europe and China, although a more than 7% pop by Apple Inc (AAPL US) certainly helped the bulls. The S&P500 and NASDAQ both trading at highs is a positive backdrop considering the overall market has prepared itself for a little bit of a hawkish message from the Fed — not necessarily that they’re going to raise rates, but just that it’ll take longer to bring rates down, i.e. back to higher for longer.

Wednesday is shaping up to be one of the most important days of the year for economic news in the US, as we will receive the latest indication of the path for inflation and the way in which the FED plans to react. The big day starts in the morning with the pivotal consumer price index (CPI) reading for May and ends with the Fed’s policy meeting in the afternoon. Economists expect the CPI to show just a 0.1% increase from April, while the Fed isn’t likely to change rates until the inflation picture clears, but Jerome Powell’s press conference will be listened to very closely, and the ‘Dot Plot’ scrutinized!

- Over the coming weeks/months, our ideal target for the S&P500 is ~5,500, which is now less than 3% away.

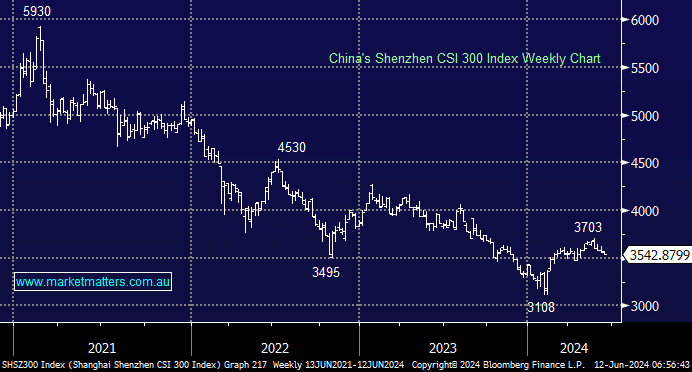

As we mentioned earlier, Chinese equities slipped to a six-week low on Tuesday, but a quick glance at the chart illustrates they are still more than 10% above February levels. After three tough years for the world’s second-largest economy, we believe it is time to “buy the dip,” but subscribers should always remember that bear markets, such as this, can often surprise on the downside, shaking out “weak longs” i.e. volatility is likely to remain in the local Resources Sector.

- We believe Chinese and related indices are “looking for a low”.