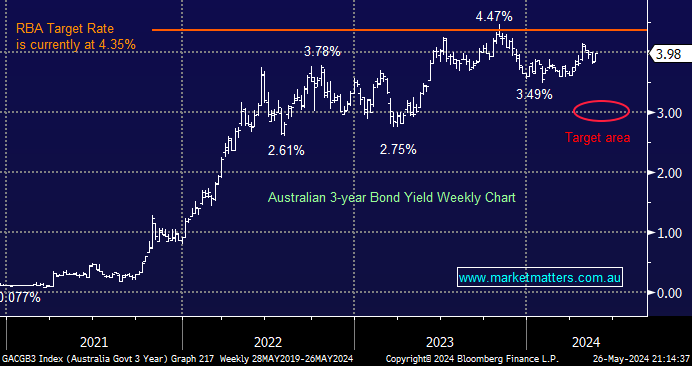

Australian 3-year bond yields edged higher last week as the Fed Minutes weighed on bond prices, pushing yields higher. The magnetic pull of the 4% level continues to control this pivotal market – it’s now almost 12-months since the Australian 3s moved to 4%, and after much jockeying and speculation, they’re still here! We continue to believe the next meaningful move will be on the downside, with the when being the “million dollar” question.

- We are targeting a move by the local 3s down towards 3% in 2024/5, a move which should provide a bullish backdrop for equities and especially rate-sensitive stocks/sectors, but that move has been a stubborn one so far.

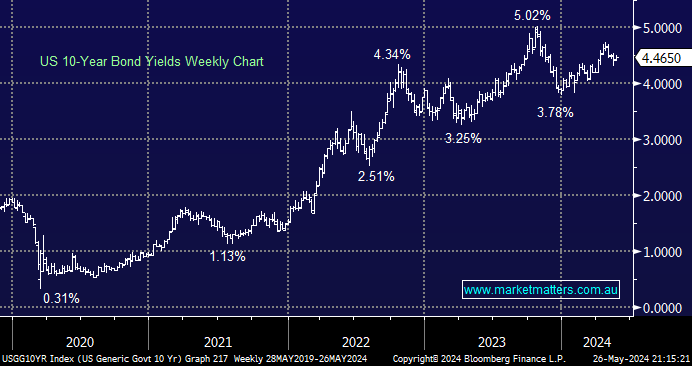

The US 10s are one of the biggest drivers of equity prices, and the fact they are hovering in the middle of the last 12-months range is a testament to how strong stocks have been since they turned aggressively higher in November. As subscribers know, ultimately, we are looking for a rally in bonds/drop in yields, but a few more months of choppy uncertainty wouldn’t surprise us.

- We’re ultimately targeting a retest ~3.5% for the US 10s through 2024/5 – again setting a positive backdrop for stocks.