Last week saw Australian 3-year bond yields edge lower after recent strong gains helped by a lack of fresh hawkish news locally, a calming lead from the US after the Fed left rates unchanged, and market-friendly employment data on Friday night. However, from a technical perspective, we need to see the 3-year yield back below 3.8% before feeling confident that they’ve started to reverse lower toward our target area.

- We still believe the local 3s can test 3% in 2024/5, although clear signs of inflation turning lower will be needed for the next downside leg to commence.

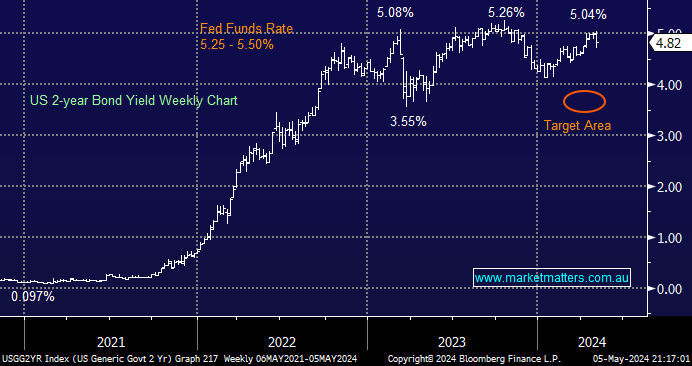

US policymakers left rates unchanged last week, and although they did reiterate that inflation is not beaten, the important takeaway which markets latched onto was the Fed’s view that their next move is likely to be a cut, as opposed to a hike. However, we are conscious that the markets are still looking for two cuts into early 2025; future inflation prints will need to fall towards the Fed’s 2% target from today’s 3.5% before confidence will return that more will be delivered.

- We’re still targeting a retest below 4% for the US 2s through 2024/5, but the economy will need to slow before the Fed starts cutting rates.

- The US futures market is pricing in two rate cuts by January 2025, arguably the best-case scenario for the doves.