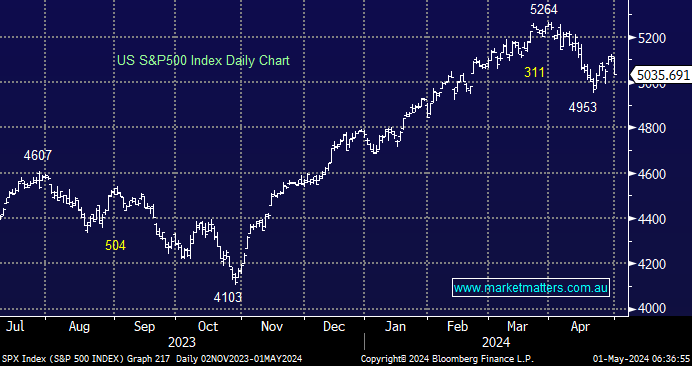

US indices endured a -1.6 % fall overnight to end their worst month in 2024; bond jitters dominated proceedings through April before the current reporting season. This week, earnings reports will be released from a wide range of companies, including Amazon, Apple, Pfizer, Coca-Cola, McDonald’s, and Starbucks. Speculation that the Fed will keep rates unchanged at a two-decade high, in “higher for longer” fashion, continues to rattle stocks and bonds. April ended a 5-month winning streak for the S&P500, and after last night’s retreat, our preferred scenario is we see US stocks dip under 4950, or at least another 2% lower, i.e. there is no hurry to put our elevated cash levels to work just yet.

- We see no reason for Jerome Powell to change his cautious tone on inflation, especially while the labour market remains strong.

- US earnings season is in full swing, and so far, so good, which is helping to partially offset the larger macro concerns that have been weighing on markets.

This morning, Amazon.com (AMZN US) reported its earnings after the market closed. They beat expectations, reporting $143.3 billion in revenue, up 13% year over year, and earnings per share of $0.98, well above analysts’ expectations $0.83. Amazon’s two big profit drivers, Amazon Web Services and advertising posted year-over-year revenue growth of 17% and 24%, respectively. Overall operating income reached $15.3 billion in the first quarter, compared to $4.8 billion a year ago, and well ahead of estimates. The stock was trading up 1% in after-hours trading on Tuesday.

Precious metals fell overnight, with gold down 2.3% and silver down 3.1% as markets further priced in interest rates being “higher for longer” which put upwards pressure on the $US. We are looking for a swing low for bonds and precious metals with plenty of potential catalysts in the near term, from the Fed tomorrow to US employment data on Friday. Market sentiment is slowly starting to nudge extremes in terms of future rate moves by Jerome Powell et al., i.e. in March, the market had factored in three cuts by Christmas; now, many economists believe they won’t get one, although the futures are still targeting one cut in 2024.

- We have been looking for gold to consolidate its strong 2024 gains, and this is playing out as we type. We believe further weakness will prove a buying opportunity.