Crude oil feels like it has been on a volatile journey as Middle East tensions escalate; we only have to visit the petrol pumps to see its advance in 2024, with Premium 98 around $2.50 at many locations around Sydney. However, if we sit back and look at where crudes traded over the last few years, it’s been in a sideways congestion pattern, and we’re pretty much in the middle of the range today.

- We believe the risk/reward favours a cautious stance towards crude oil as geopolitical tensions could see a sharp rally at any time, but without this volatile backdrop, oil is clearly comfortable at the current price.

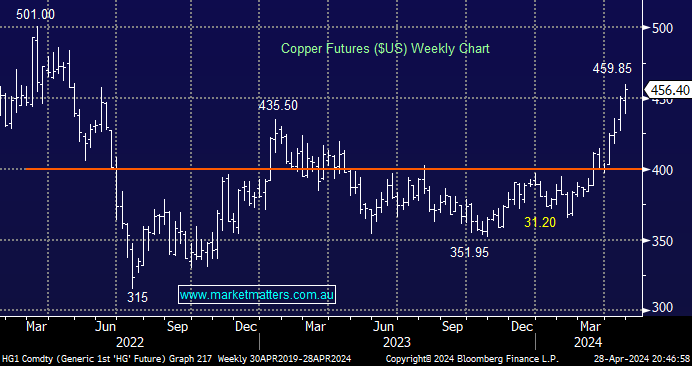

BHP’s bid for Anglo American PLC (AAL LN) is a huge vote on the looming shortage of the industrial metal by the Big Australian, i.e. BHP Chief Executive Mike Henry is attempting to advance his global copper interests after repeatedly warning there is not enough supply to electrify the global economy and meet climate targets. It is simply supply & demand, if there’s not enough supply, prices rally, making more money for the respective miners. Hence, BHPs grab for copper assets, i.e. in 2023, they bought OZ Minerals (OZL) for $9.6bn; now they’re after AAL, whose copper assets dwarf those of OZL.

- No change; we are bullish on copper – last week’s strong move to multi-month highs is on track to take the industrial metal back towards the psychological $US5.00 area.