What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

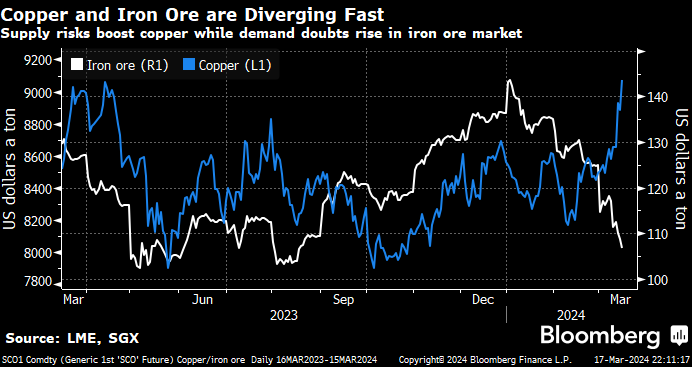

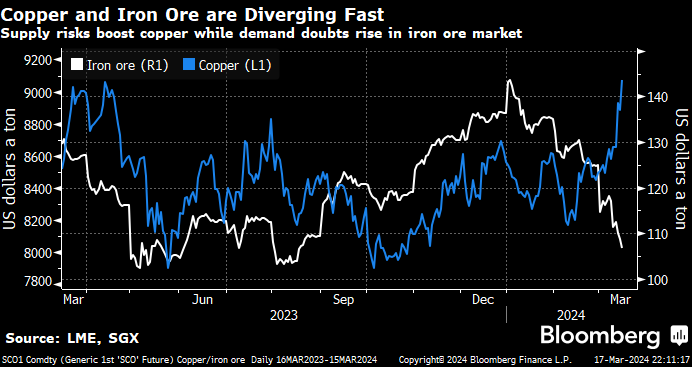

Copper was the shining light in an otherwise tough week for local stocks, with the industrial metal surging almost 6%, testing 12-month highs in the process. Ironically, the advance coincided with iron ore making fresh 7-month lows, with the divergence between two of Australia’s most important exports certainly garnering plenty of attention. Iron ore has slipped over 30% since early January as Beijing fails to lift hopes around the health of their construction industry, leading to loss-making steel mills buying less ore and creating stockpiles at Chinese ports.

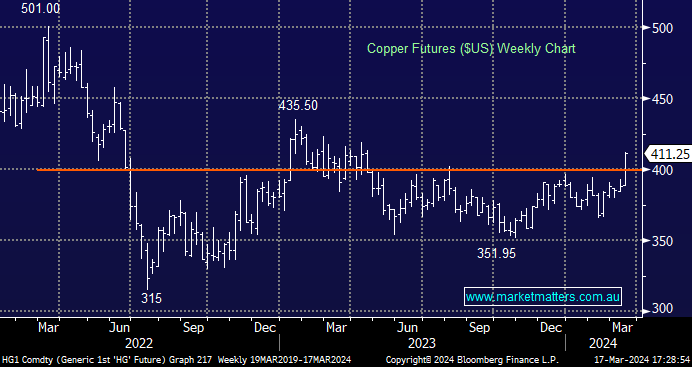

- Copper spiked higher on supply concerns after treading water for months, even as its primary consumer, China, has struggled to stimulate its sluggish economy. We believe the advance is in its infancy.

- The steel-making ingredient slipped ever lower on Friday as traders believed China’s property crisis would continue throughout 2024, keeping a firm lid on demand. We think the sector is “looking for a low,” but there are no clear signs yet.

The pick-up by copper would usually be the precursor for some optimism across all commodities. Still, so far, it has primarily been focused on the industrial metal. However, MM believes the panic washout in the “ESG/Green Trade” is behind us, and lithium stocks will improve through 2024, e.g. copper is increasingly being used in EVs. China’s traditional industrial economy is even relatively weak for copper, with stockpiles increasing to multi-year highs. Still, the market believes the increasing usage of copper in EVs and renewables will more than offset the weakness in China’s industrial economy. Also, there’s growing optimism around India’s consumption of copper, with the fastest-growing major economy set to plug the Chinese demand hole until Xi Jinping et al. can turn the corner.

The primary catalyst driving the copper advance has been the tightening of global mine supplies following the closure of a mine in Panama and potential output concerns from Zambia due to their power crisis. We were particularly encouraged by the metal’s ~2% advance on Friday, even after China stockpiles rose; we believe this has the makings of a structural shift in the copper price through 2024/5, with both supply & demand tailwinds set to unfold.

- Copper can rally another 15-20% over the coming months, while iron ore will improve when we see glimmers of hope from China’s property market.