US stocks struggled overnight after a few comments from Fed members that further work was required on inflation before rate cuts can flow – futures markets are now pricing in ~1% worth of cuts by January 2025, leaving room for some disappointment, in our opinion. Tonight’s data will deliver a more concrete read as the market evolves its attention from company reporting to the macroeconomic landscape.

- We reiterate that our preferred scenario is to see further consolidation over the coming weeks/months as opposed to a major pivot/pullback, but the risks remain on the upside.

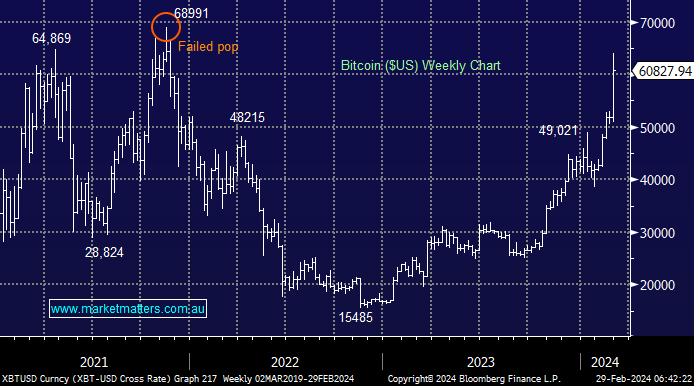

Overnight, we saw the crypto heavyweight explode above $US60,000 for the first time since late 2021, and we wrote earlier in the week that “The current bullish momentum suggests a break of the psychological $US60,000 area isn’t far away” – that was an understatement! The important takeout by MM is that there’s still plenty of liquidity in the system looking for a home, an ongoing bullish read-through for equities and risk assets.

- We can see Bitcoin consolidating in the $US60,000-$US70,000 area over the coming weeks, after its recent surge higher but its not a market we would short.