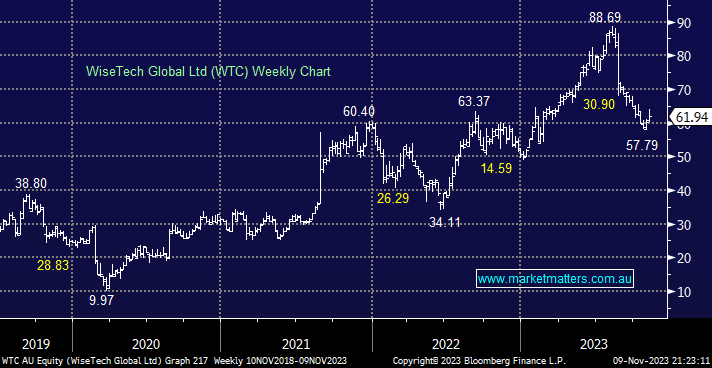

WTC was the high-flying sector darling in August, but a disappointing result has seen the stock fall -35%, illustrating another example of the current market’s brutal reaction to misses on any level. The software solutions company delivered weaker-than-expected guidance in late August, similar to many businesses this year, i.e. FY23 has been good, but people are being cautious around FY24. Profitability is heading in the correct direction, but the share price had run hard, which made it easy for the stock to correct sharply. However, we believe it remains a solid business with 96% recurring revenue, but again, with a valuation of 78x, investors need to see growth.

- We like the risk/reward toward WTC around $60, but we are not looking to increase our exposure to tech at this stage of the cycle.