US indices rallied overnight after their longest decline in 2023; the tech stocks led the way, with the NASDAQ closing up +1%, helped by strong moves by Spotify (SPOT US) +9.7% and Alphabet (GOOGL US) +1.9%. Below the hood, only the Energy Sector fell, closing down -1.4%, following a ~2% fall by crude oil, while Microsoft (MSFT US) was a small loser amongst the tech stocks after being sued by California over harmful youth marketing claims.

- We are bullish stocks into Christmas, but looming earnings reports by Apple, Microsoft, Alphabet, Amazon, and Nvidia cannot afford to disappoint in today’s nervous market.

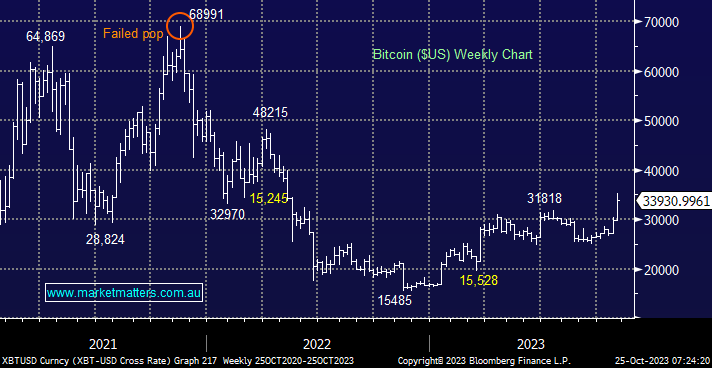

Bitcoin hit a 1-year high overnight, fuelled by hopes of increased demand from ETFs, the best-known crypto has almost doubled from its panic sell-off low in 2022. The potential approval in the coming weeks of the first US spot Bitcoin ETF is getting the speculators excited – heavyweight Blackrock and Fidelity are in the race to offer these ETFs.

- We don’t believe the current rally by Bitcoin can used for its usual read-through on market liquidity for stocks, i.e. it is event-driven.