What Matters Today in Markets: Listen Here each morning

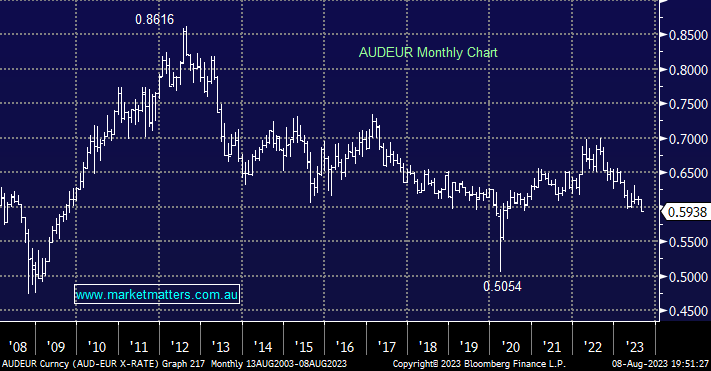

The Australian Dollar has been coming under increasing pressure over recent months, when we compare it to the Euro (EUR) the story is even worse than against the Greenback, a European holiday is now costing over 12% more than at this time last year. The negativity towards “The Little Aussie Battler” has been picking up momentum through 2023 with 3 issues weighing on the local currency:

- Investors are not convinced that Beijing can lift the flagging Chinese economy, a bad read-through for Australian exports and especially local resource stocks.

- The RBA Cash Rate is below that of many countries such as the Fed & ECB meaning that effectively it costs money to hold the $A i.e. lost interest for say Europeans/Americans compared to their own FX.

- The outcome and implications of “The Voice” are far from clear and as we all know markets simply hate uncertainty hence the phrase: “If in doubt stay out”.

We’ve been looking for the $A to recover through the 2H primarily because we are expecting an economic recovery from China and an eventual decline by the $US as bond yields reverse lower however on reflection when we consider the above 3 points it’s easy to comprehend why the $A is in the proverbial naughty corner e.g. even when compared to fellow “commodities currency” the Canadian Dollar (The Looney) its already depreciated -5.2% this year.

- The downside momentum of the $A is showing no signs of abating.

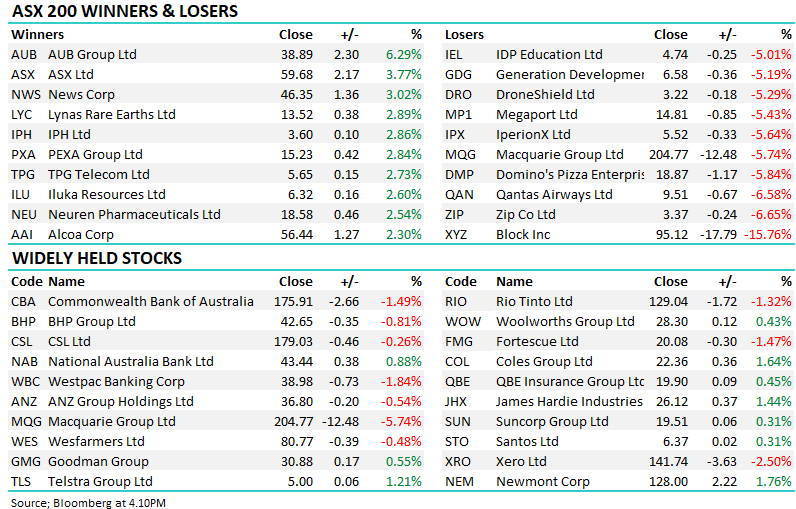

The ASX200 ended Tuesday up just +0.03% with most of the action unfolding on the stock level – no surprise during reporting season! It’s been a frustrating start to this season for the MM Flagship Growth Portfolio with ResMed’s (RMD) miss sending the stock down over -10% while James Hardie (JHX), where we took a +28% profit in late June, popped another +14.4% yesterday after better margins helped deliver a significant beat on earnings, fortunately, we have a few more weeks to address this average start.

The theme through most of 2023 has been the strong getting stronger and vice versa and this is playing out early this reporting season with buyers showing no interest in buying dips after a disappointing result – not classic bull market price-action but very befitting of one of the most hated bull markets in history. This morning will see a big test for the financials with investors needing to digest Commonwealth Bank (CBA) and Suncorp (SUN) results this morning – more on CBA later.

- The SPI Futures are pointing to only a small dip early this morning helped by a +10c advance by BHP in the US.