We have already missed a couple of opportunities where stocks which have been struggling over the last 2 years sprang back to life with a vengeance, one we even discussed days before it rocketed higher. However, we don’t find this disheartening more a confirmation of the trend we are expecting to unfold through the 2H.

- We believe a number of the market’s “dogs” will enjoy far better performance through the 2H as investors look for value in a market that’s no longer cheap.

The last 1-2 years have been all about the “strong getting stronger” and vice versa but like all good trends, long and short, they eventually turn &/or simply run out of steam. However, we believe it’s very important with today’s theme, which we have touched on previously, to adopt the simple adage of “if in doubt stay out” as not all companies will turn the corner if bond yields for example move lower, some are simply in need of serious repair.

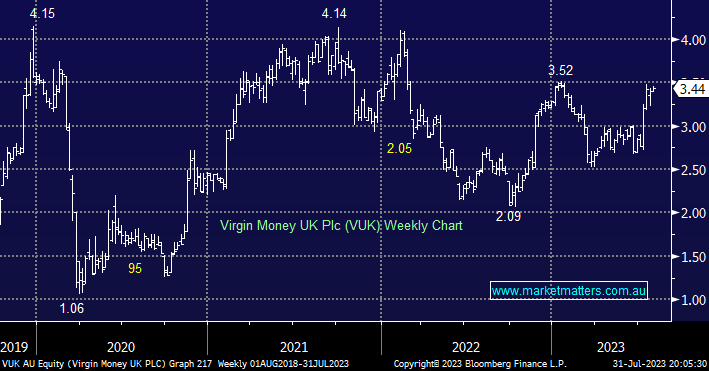

The 1st example of one stock recovering strongly is VUK which popped strongly after passing “Stress Tests” unlocking capital that might be used for buybacks. Even after rallying almost +40% the stocks trading on less than 6x making it cheap in our opinion – an eventual test of $4 wouldn’t surprise but we would now need the stock closer to $3.25 for its risk/reward to look enticing.

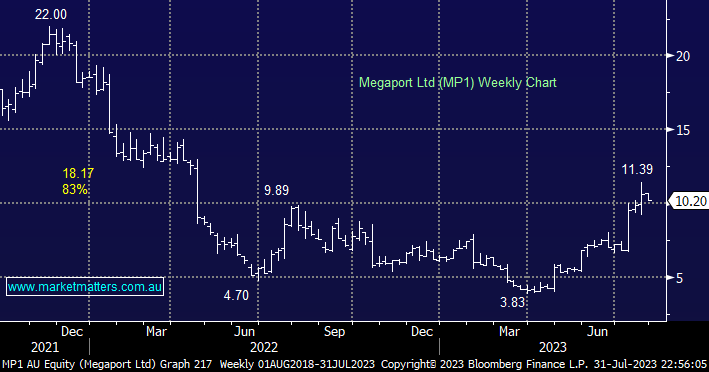

Another stock that has surged higher of late is Megaport (MP1), the stock rallied over +40% in July alone following an upgrade that showed their resetting strategy was on track – a few shorts having to cover helped catapult the tech stock higher.

Moving onto 3 stocks that could be poised to recover: