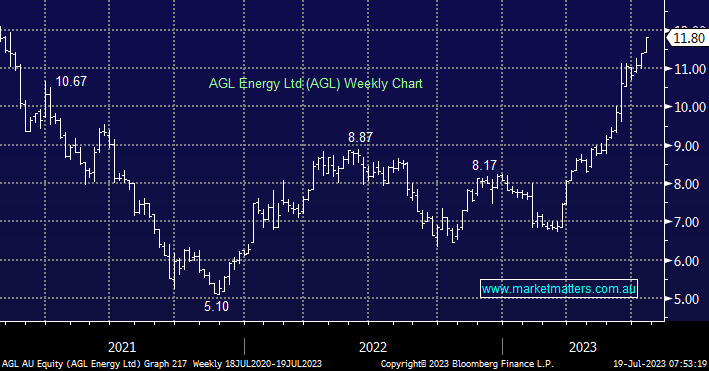

JP Morgan upgraded AGL Energy (AGL) yesterday from a hold equivalent ($11.20 target) to a buy-equivalent and 12-month target of $14.30, making their analyst, Mark Busuttil, the most bullish on the street. The stock has done phenomenally well this year up 46.22% outpacing even MM’s expectations, serving as a great reminder of how influential investor positioning can be, particularly in large-cap Australian shares. In recent years, there has been low to no interest in the ‘dirty’ AGL, however, that perception has changed dramatically.

As we wrote back in February (here) after their ~$1bn non-cash write down which sent shares back below $7, if we think about the ‘new AGL’ which starts to sell the vision of renewables and makes very tangible steps towards making that a reality, while growing earnings strongly, and perhaps leveraging their ~4.5m strong customer base into things like internet or even insurance, the narrative could change very quickly. FY23 is being a tough year, however, they say it’s always best to buy straw hats in the winter!

In February we expected FY24 earnings per share (EPS) of 84c, a rise of 125% on FY23. That number has since been revised higher with consensus now expecting EPS of $1.04 in FY24 & $1.15 in FY25. So, FY24 is now 24% above where we thought it would be while FY25 is 15% above our original expectations, yet the stock has rallied 68% from sub $7, prompting the question, has the market now become simply too optimistic on AGL after being too pessimistic?

The short answer is no. The earnings recovery here is a very strong one, and on these recut expectations for FY24, AGL is trading on an Est P/E of 11.2x, around 18% below its historical average, while that historical average is arguably low given the ‘old-world’ nature of their asset base versus the ‘green vision’ of their future.

- While earnings continue to grow, we intend to retain our position in AGL Energy.