AKE +15.72%: announced a merger with US group Livent (LTHM US) to create the world’s 3rd largest lithium producer forcing shares in lithium miners to squeeze higher today. Allkem shareholders, which was born out of a merger between Galaxy and Orocobre, will own 56% of the combined group, however, Livent’s CEO Paul Graves will be tasked with combining the assets across Canada, Argentina and Australia. The deal is expected to save $US285m in both cost synergies and CAPEX net of the costs involved in pulling the deal together. Talking their own book, the group expects to benefit from its scale attracting customers demanding a large supply of various lithium products, expecting to produce more than 200kt/year of production within 5 years. We suspect there will be plenty more M&A in the space in the near term.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

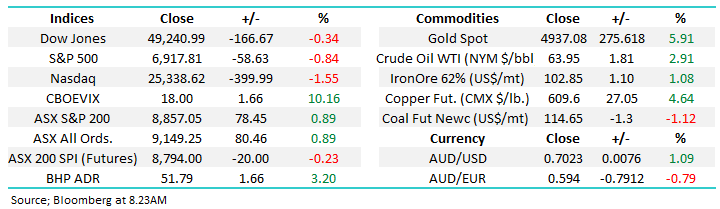

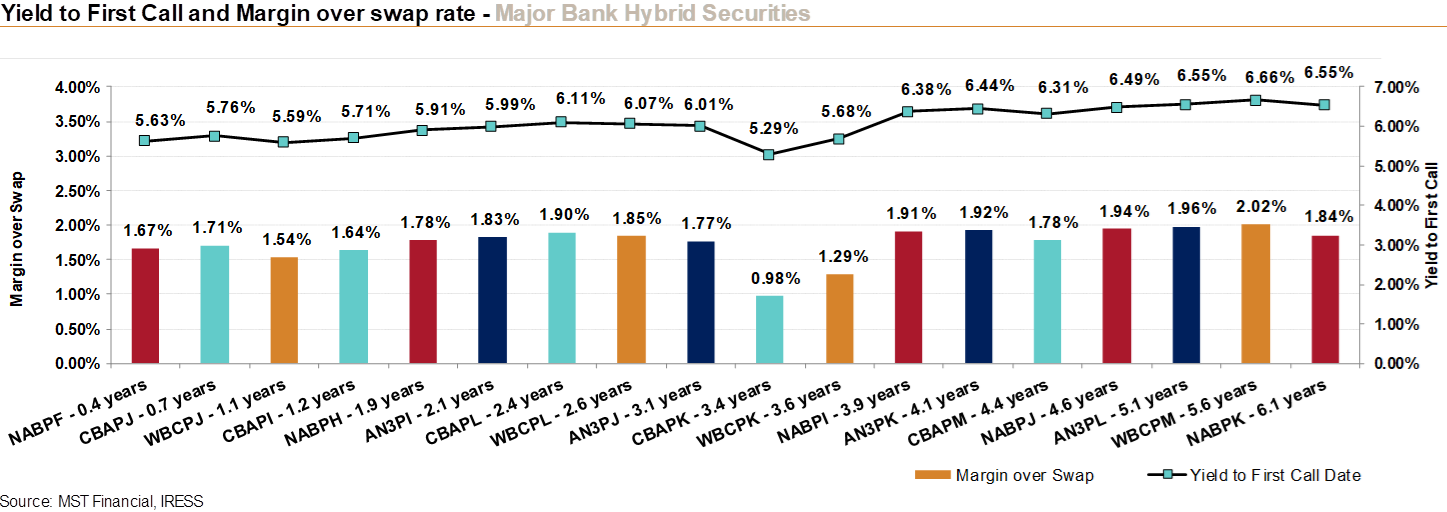

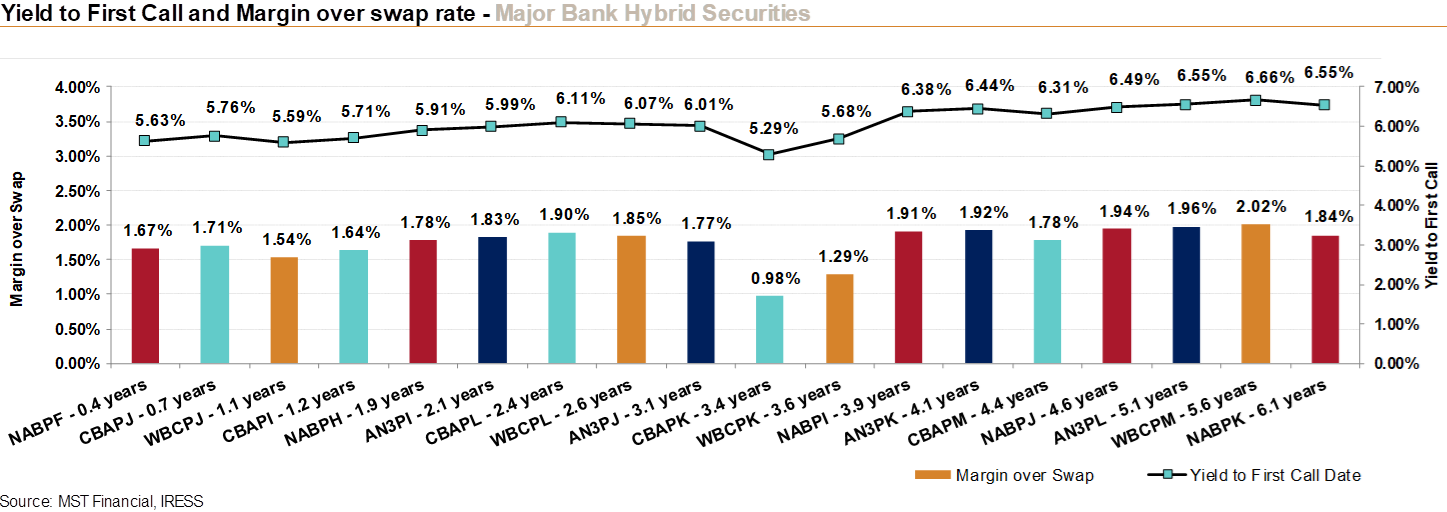

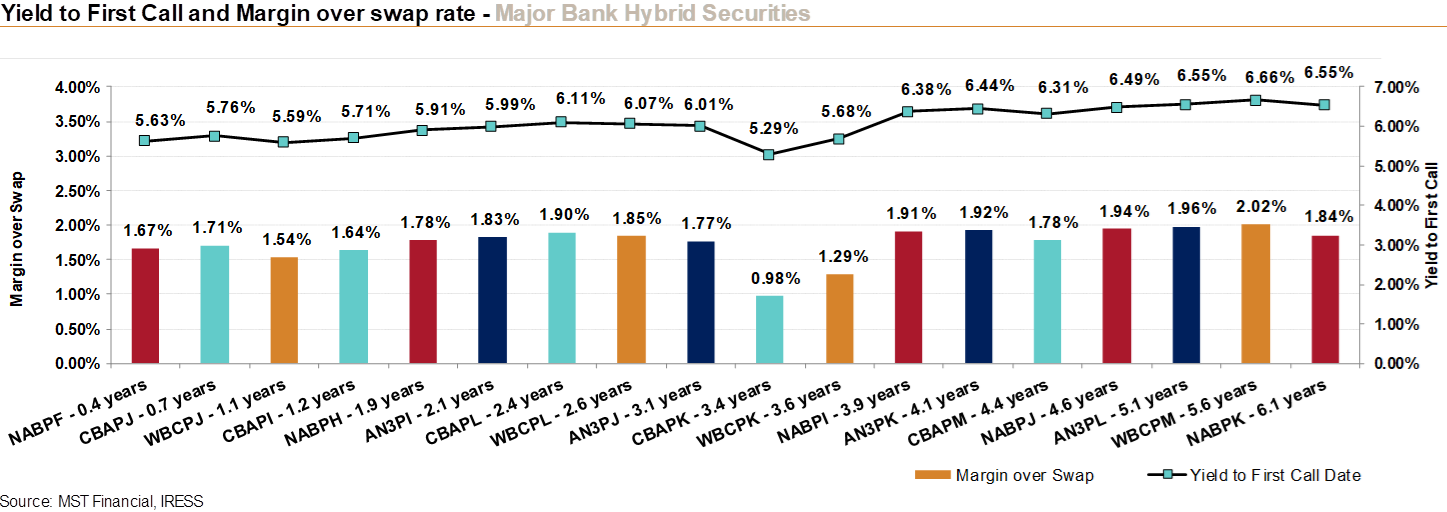

Yield to first call & margin over swap – Source MST Financial

Yield to first call & margin over swap – Source MST Financial

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

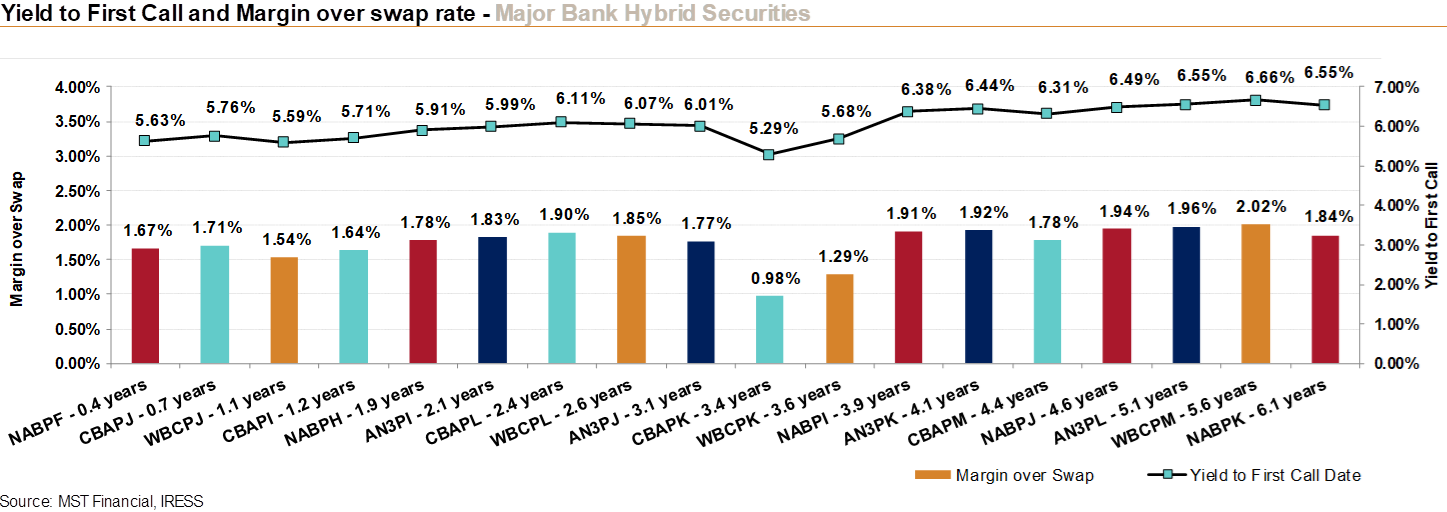

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish Lithium, owning PLS & GL1

Add To Hit List

Related Q&A

Allkem thoughts on risk/reward below $9.50

AKE

What does MM think of Allkem (AKE)?

Is it too late to chase the “Lithium trade”

Lithium – ORE or PLS?

The ORE & GXY Lithium merger

Decarbonisation, a growing thematic

MM views on PLS

EV space – best company

Question on ORE

Relevant suggested news and content from the site

chart

Yield to first call & margin over swap – Source MST Financial

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.