The US market closed basically unchanged overnight as investors weighed further bank earnings against additional comments from 2 Fed officials who favour ongoing rate hikes to combat inflation. Goldman Sachs (GS US) slipped lower following its report while the Bank of America (BAC US) rose, its extremely early in reporting season but the VIX is comfortable trading at its lowest level since January – some would say it’s complacent but history has shown us this condition can last for months. Interest rate-sensitive 2-year bond yields edged higher suggesting to us that markets are resolved to at least one more hike by the Fed in the months ahead.

- From a risk/reward perspective we are now leaning towards selling strength as opposed to buying weakness as indices approach our target areas.

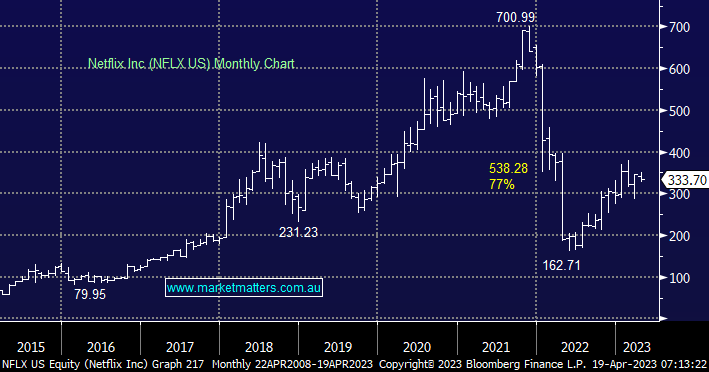

Going into its result this morning options on Netflix NFLX US) were suggesting a likely +/- 8% swing following the result, and that was on-point with the stock dropping ~10% straight after the numbers dropped, but 15 minutes later the stock was trading up just +0.3%! The result itself showed revenue of $8.24bn falling short of the average estimate of ~$8.47bn while operating margins came in at 19% compared to estimates of 20.7%, if the stock can hold up in the face of these relatively disappointing numbers it would fit the bill of “not too bad is good enough” with their outlook for a better period ahead the aspect that investors latched onto.

- We aren’t considering NFLX at this stage but it is a good illustration of how volatility has diminished following the rerating of growth stocks through 2022.