What Matters Today in Markets: Listen Here each morning

*Note: A number of subscribers requested Coal Futures pricing to be included in the top table. This has now been added. We are using the Active Futures Contract out of Newcastle as supplied by Bloomberg.

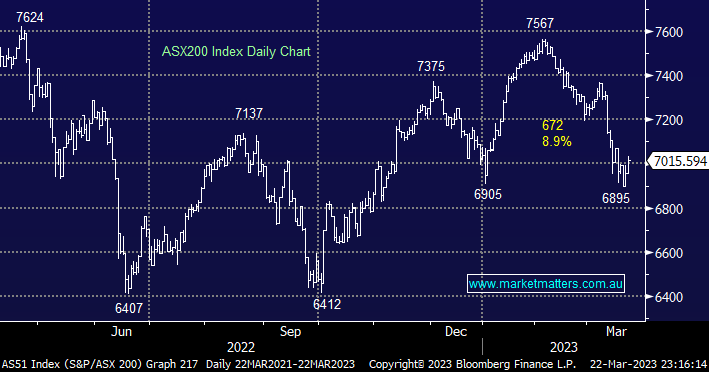

The ASX200 enjoyed a solid 60-point rally on Wednesday as investors weighed up what the Fed would both do & say this morning. Hopes have been rising that the Fed’s interest rate decision and accompanying minutes will address investors’ concerns of a potential meltdown across the global Banking Sector. The rescue of Credit Suisse by UBS had returned some order to financial markets but the interpretation of Jerome Powell’s statement over the next 24-48 hours is likely to dictate risk appetite over the coming weeks.

- Going into this morning’s Fed meeting the Futures market was pricing in a 0.25% hike, below the anticipated 0.5% hike before the banking crisis.

- The RBA is already considering a pause from its aggressive hiking cycle if upcoming retail trade and inflation data don’t prove “too hot”.

This morning we indeed saw Fed hike by another +0.25% although the accompanying speech from Jerome Powell was noticeably positive towards the US banking system while also remaining mildly hawkish as they still expect higher interest rates to curb inflation.

- The Fed extended its year-long fight against inflation by hiking rates another 0.25% while stating in a written statement “The U.S. banking system is sound and resilient”.

- However they also warned that the financial upheaval stemming from the collapse of the 2 major banks is “likely to result in tighter credit conditions” and weigh on economic activity, hiring, and inflation”.

- Importantly the Fed also signalled it’s likely nearing the end of its aggressive series of rate hikes i.e. the statement has been toned down to “some additional policy firming may be appropriate”.

We feel there was something in this morning’s move and statement for both the bulls and bears hence its easier to watch the market’s interpretation, initially the market embraced the Fed’s actions albeit in a restrained manner but Treasury Secretary Janet Yellen rattled bank shares which compounded the impact of Jerome Powell dashing hopes of rate cuts this year – she said the government is not considering blanket deposit cover for deposit holders in US banks, a surprising comment in our opinion after their concerted effort to stabilise banks, her comments sent the Financial Sector down -2.4% with only Real Estate Sector faring worse as it got whacked another -3.6%.

US stocks experienced a very choppy session following the Feds hike and statement before Janet Yellen’s unsettling comments, we find it extremely hard to believe they can cherry-pick which depositors they will save e.g. the Dow closed down over -500 points after trading in positive territory at the start of the last hour i.e. the “hour of power”.

- Following the declines across US indices the SPI futures are calling the ASX200 to open down 50 points, not helped by an 80c fall by BHP in the US.

MM has been banging the tech drum through 2023 as we targeted an end to the aggressive rate-hiking cycle by central banks which should theoretically lead to a sharp bounce by the battered growth stocks and especially high beta tech names i.e. the pointy end of the group. So far this view has played out reasonably well in the US but it’s dragging the chain on the local bourse. A frustrating relative journey to date but we still like tech stocks in general through March/April.

- The NASDAQ has rallied +15% in 2023 while the ASX200 Tech Sector is up just +5.8%.

Important to note the local tech sector doesn’t enjoy the same depth or breadth as the US tech sector. At this stage, while we’re not abandoning our bullish call on the domestic tech names, we accept that the local sector will likely underperform the larger household names in the US as money continues to flow to the big end of town.