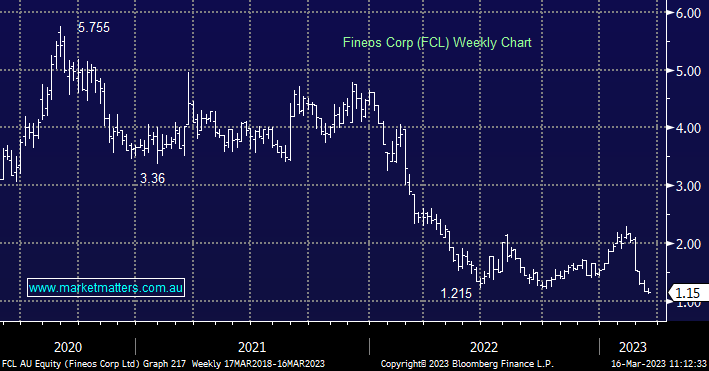

Does MM like Fineos Corp (FCL) after its recent fall?

Hi Team, Thanks for the feedback on my previous questions. While the market was disappointed with Fineos (FCL) Corp’s bigger first half loss in Feb; largely because of a higher-than-expected rise in expenses. Management has highlighted that closing sales deals has been slower, however, the pipeline is very strong and these opportunities have not been missed, only moved out to later in 2023 when cloud activity is expected to grow. The stock price has dropped from over $2 before the announcement to $1.125 today (14/Mar). I would like to hear what the MM team think about the short to medium prospect of this company. Thanks again for taking my question.