Ask James- REITS

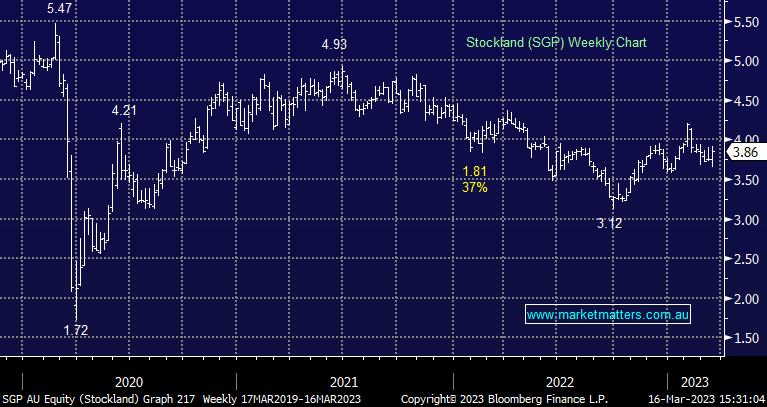

Thanks for your efforts ongoing! You timed your exit from SGP very well, but it appears to have rapidly stabilised and if rates are now close to pausing, where would you consider an appropriate entry point. NSR has held up well, but ABP (diversified, but large exposure to Kings Storage) has struggled. Do you see value (or relative value) in one over the other.