Hi Paul,

A more mild Northern Hemisphere winter has reduced demand for coal and that has put downward pressure on the underlying coal price. Coal Futures out of Newcastle are this morning trading at $US220.65/tonne, down from levels of ~US$400/tonne in September of last year (refers to the active contract). In terms of WHC, they gave a Dec QTR update at the end of January, saying that they had achieved an average coal price of A$527/t for the quarter, compared with A$581/t in the September quarter – these are very strong numbers and they expect to report an H1 FY23 EBITDA on 16 February of around $2.6 billion. For FY23, consensus is for WHC to produce EBITDA of $5.08bn, so they are on track to do that, however, like all resource companies, these earnings are dependent on commodity prices which have fallen. While there is a lag effect between the price we see and what WHC has contracted cargoes at, this lower price environment will impact their earnings in time, hence the ~30% fall in share price which is probably about right in terms of a likely reduction in earnings for the 2H.

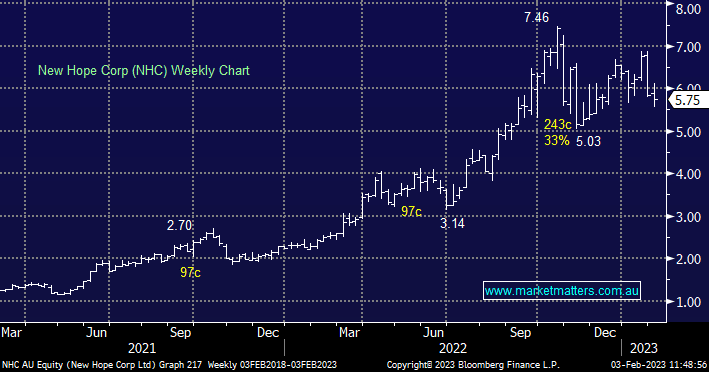

The question then becomes, is this a short term pullback in Coal prices or something more entrenched? We think it’s the former (given lack of new supply) hence we retain a positive view on the sector. We like both New Hope Corp (NHC) & WHC into further weakness, we are considering accumulating WHC below $8 and NHC below $5.50, however, our position size would be no greater than 5% in each (WHC is held in the Growth Portfolio & NHC is held in the Income Portfolio).