PPT bounced +3.2% yesterday and dragged Pendal (PDL) up as a consequence given the looming takeover that seems likely to proceed, with the ratio now worth $5.16 for each PDL share versus yesterday’s close of $4.99 i.e. PDL is still the cheaper way to buy Perpetual (PPT) and the reason we own PDL in the Income Portfolio.

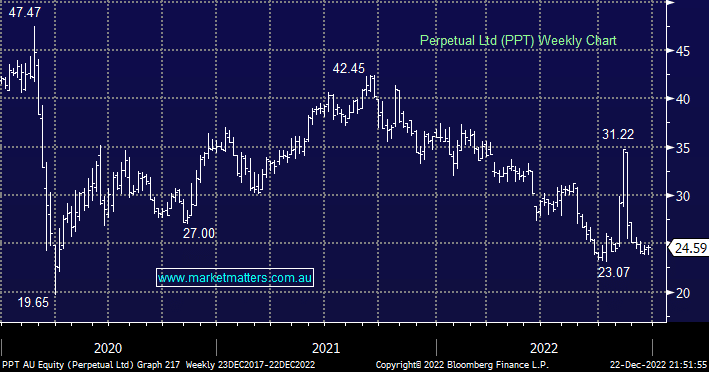

Clearly, fund managers have had a tough last 18 months with PPT’s share price halving, sector multiples have moved from ~17x and are now struggling to hold ~10x with the Hamish Douglas circus doing nothing for the perception of active managers. Perpetual, and by extension, Pendal are slightly different with more strings to their bow including a sort after and more defensive Trustee business (worth north of $1bn), Wealth Management and of course, Funds Management.

- While PPT may break this year’s low, we think deep value exists here, and for patient investors, the risk/reward is now attractive.