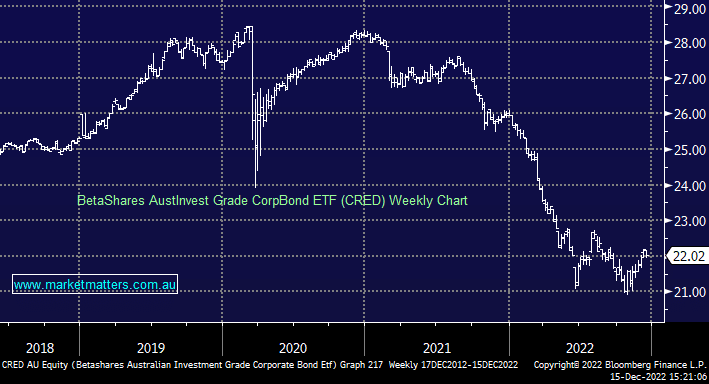

Views on the BetaShares Australian Invest Grade Bond ETF (CRED)

Please give your views on CRED including: 1) whether or not you like it; 2) whether you think now or a lower price target is a good time to buy it; and 3) how you expect it to perform going forward in the current environment with respect to price performance/yield, including with regard to your expectations for interest rates over the medium to long term.