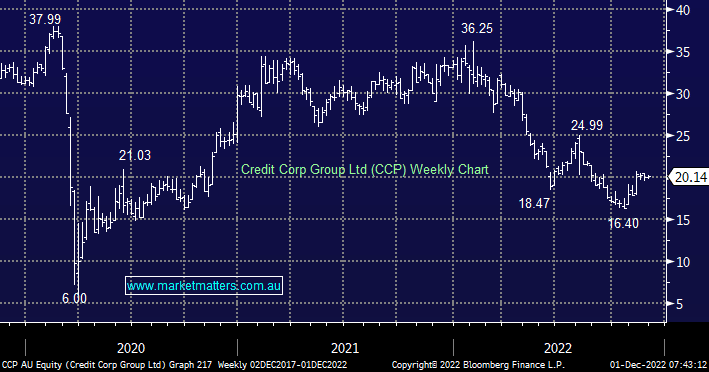

Debt collector CCP more than halved from its 2021 high but it feels like the weakness which followed its August result, albeit in a falling market, may have washed out the sellers and it looks good ~$20. Importantly from an investment perspective, the result led to weakness as the company guided a lower net income of $90-$97m but on 14.4x FY23 earnings, CCP is still around fair value in MM’s view. While we’re all concerned about economic stress, ironically, one of the issues facing CCP is the availability of bad debts to collect, these are at low levels making them expensive. Bad debts are essentially the company’s inventory.

- We like CCP and can see over 20% upside over the coming weeks.