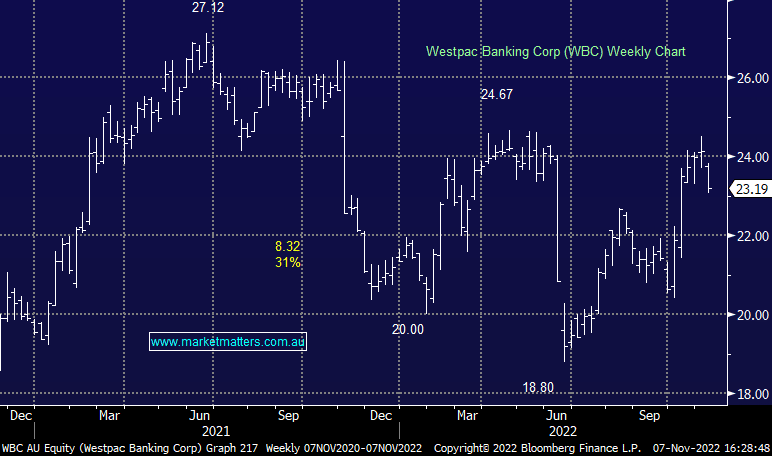

WBC -3.91%: Was lower today following their FY results that were in line with expectations. Cash profit of $5.3 billion was down 1% vs 2021 but in line with consensus while the dividend of $1.25 beat by 2%. Costs were a focus and these were revised up for FY24 to $8.6b (+$600m on prior guidance) given the impacts of higher inflation including wage increases from a tight labour market and continuing regulatory spend. This is perhaps the reason for the market sell-off although we would argue this was a ‘known known’ and should not have come as a big surprise. Looking at core operating trends, the results were very solid, business banking a highlight while John Storey at UBS made a good point around whether or not the new cost guidance is credible – perhaps concern around that played into weakness.

Banks have a good handle on broad economic trends, and some comments from CEO Peter King stood out…“If I step back to the macroeconomy, it’s just really strong. We went through a period where businesses didn’t want to put up their prices because they were worried about losing market share. Now we’re in an environment where they are putting up prices and spending is still staying pretty high. And so, the Reserve Bank’s got a pretty tricky trade-off.