Hi Debbie,

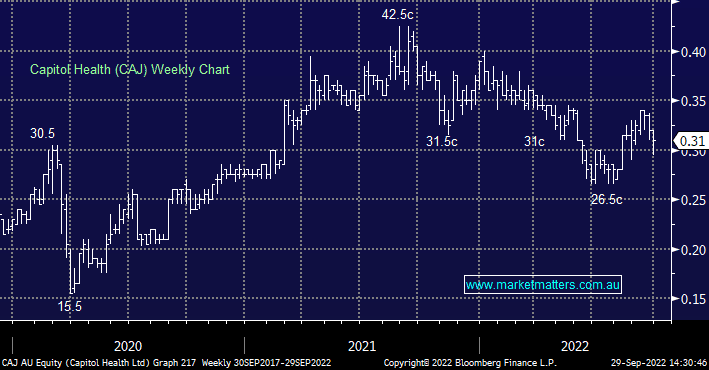

Capitol Health (CAJ) 31.5c – MM remains long and bullish CAJ in our Emerging Companies Portfolio, we believe it looks good ~30c. Recent Medicare data is supportive of this thesis.

Healius (HLS) $3.36 – no change to our comments a month ago MM is neutral at best healthcare business HLS, they were a COVID beneficiary however we are unsure where earnings will land in a normal environment.

Inghams Group (ING) $2.40 – we believe this poultry stock’s finally offering value under $2.50 after falling more than 40% over the last 12-months but its unlikely to be on MM’s shopping list until inflationary pressures subside. These guys are feeling it at many stages of their production process from feed to transport and of course wages.

Overall our portfolios are largely in-line with our outlook into 2023 but a couple of potential sell / funding candidates are TPG Telecom (TPG), Strandline (STA), Metcash (MTS) or Wesfarmers (WES) and PointsBet (PBH).