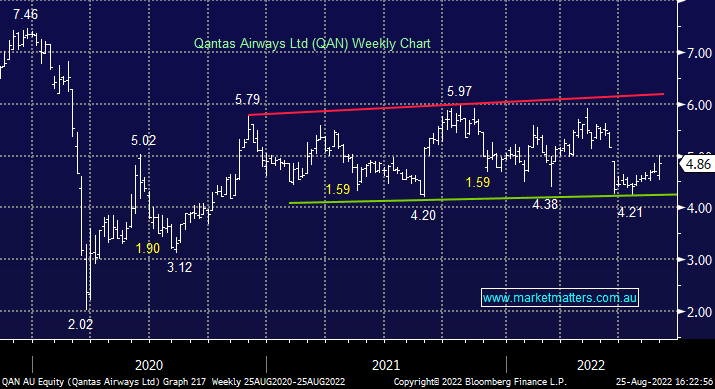

QAN +7.05%: the flying kangaroo posted significant losses for FY22 however the numbers were largely in line with expectations and performance continues to improve. Underlying EBITDA in the second half was $526m, towards the top end of guidance, assisted by a further @270m of annualized cost savings delivered in the 12 months. Domestic capacity has returned to pre-COVID levels, and total capacity in the 4th quarter was 63%. Net debt came in below their target and as a result they have launched a $400m on-market share buyback, further supporting shares but ensuring this will be a big news story tonight!

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is neutral QAN around $5

Add To Hit List

Related Q&A

MM’s view on tourism stocks

Is Qantas turning around ?

Does MM plan to buy Qantas shares (QAN)?

Does MM like the AIZ rights issue?

MM views on Qantas (QAN) & Kogan (KGN)

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.