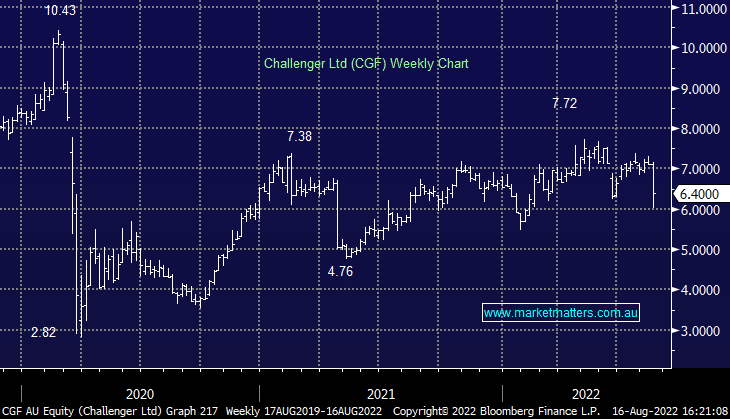

CGF –10.11%: Hit today despite their Net Profit Before Tax (NPBT) coming broadly in line with expectations, however, the composition of the result was soft which is very typical of CGF. Weaker earnings in business units were offset by lower corporate costs however, the main negative surprise came from bank losses as higher than expected regulatory and integration costs weighed. They said that bank losses would persist in FY23E and it is now under strategic review. Overall, low-quality result and the outlook was soft.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM has no interest in CGF – they simply disappoint too often

Add To Hit List

Related Q&A

MM views on CGF and CEH and global supply chain impacts of exploding electronic devices.

How does MM see Fortescue (FMG) trading through 2022?

Picking a healthcare winner

Technical thoughts on CGF & HLS

Our view of Challenger (CGF)

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.