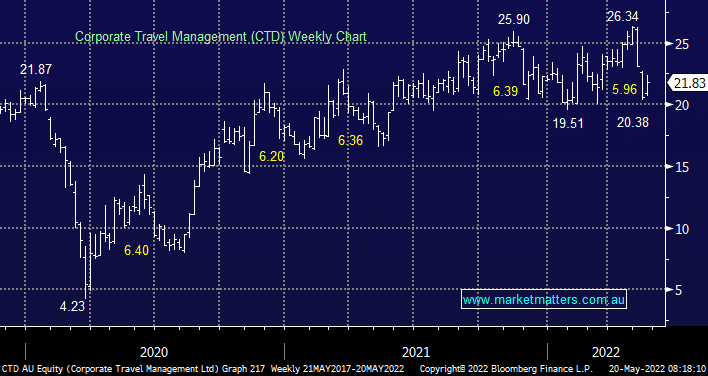

CTD is another ASX travel company which has corrected over 20% after making new highs following MM’s 2022 mantra of “sell the pop”. The company was in acquisition mode through the pandemic which should give plenty of room for growth in 2022 especially as its sits on zero debt helping create a solid platform moving into 2023. We like this business, it’s just a matter of what price represents good value, we like the stock around $20 but would leave some ammunition if it breaks support and trades into the high teens.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

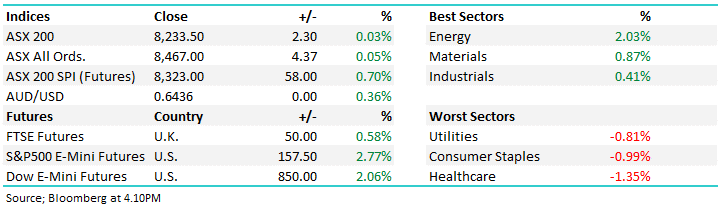

Monday 12th May – Dow down -119pts, SPI up +16pts

Monday 12th May – Dow down -119pts, SPI up +16pts

Close

Close

MM likes CTD into further weakness

Add To Hit List

Related Q&A

Preference for CTD over FLT as a “Growth’ stock

CTD in Growth Portfolio versus FLT

Are the falls by CTD and DTL opportunities?

What are your preferred travel Stocks: WEB / CTD / FLT?

Switching into Growth stocks

Comments on a few shares: CTD, GQG and SEK

Is the travel boom really over?

Does MM like Corporate Travel (CTD) here?

Your thoughts on CTD and NEC, please

ALL, CTD, CGC, A2M

Airlines & TWE

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Monday 12th May – Dow down -119pts, SPI up +16pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.