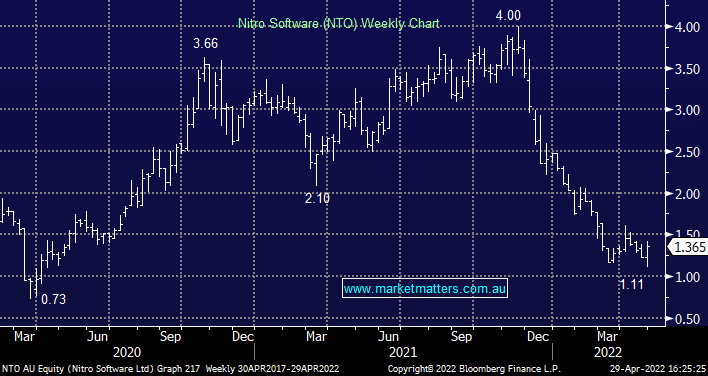

NTO +19.7%: the 1st quarter trading update provided the catalyst for a strong bounce in signature and document productivity business Nitro today. Annualized Recurring Revenue (ARR) came in ahead of guidance, up 61% YoY compared to previous guidance of 39-47%. Cash receipts were also up 42% YoY which helped reduce the cash burn to $3.6m, down from $4.5m in the previous period. With performance metrics improving early in the year, management upgraded EBITDA guidance to a loss of $15m-18m, down from an $18-21m loss in previous guidance. They now expect to be cash flow breakeven by the end of 2023 with plenty of cash on hand to get them there.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM remains bullish and long NTO in the Emerging Companies Portfolio

Add To Hit List

Related Q&A

What are MM’s thoughts towards Nitro Software (NTO)?

Update on 4 emerging company share positions

MM thoughts on WSP, AD8 & NTO

Is it time to take tweak some positions?

Thoughts on Pointsbet & Nitro?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.