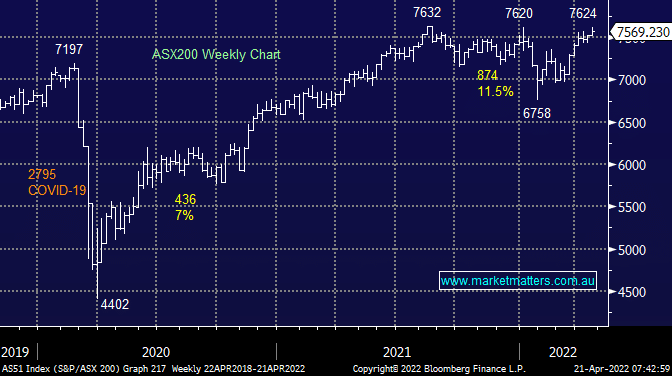

The ASX200 got within 8 points of all-time highs yesterday morning however by 4.10pm the market was 63pts off the milestone that MM has been calling for months. Not even a spectacular $20bn private equity bid for hospital operator Ramsay Healthcare (RHC) was enough to offset the profit-taking that crept into the dominant banks and resources throughout the session. Overall, a weak day with the market feeling a touch tired having already rallied +6.39% in March & is now up ~1% in April.

Importantly, while there is often profit-taking at/around highs, the recent resilience of the market in the face of rising bond yields, war, and a looming Federal election that current polls suggest will fail to deliver a clear winner implies strongly to MM that the market wants to push higher, perhaps in the direction of most pain for some given the overarching bearish sentiment that we highlighted yesterday morning.

US growth stocks have had a challenging week, the cherry atop a challenging year to date that has seen some significant destruction of value. Below is the calendar year performance of well known, mega-cap stocks:

- Netflix (NFLX US) –62.45%, Shopify (SHOP) -61.88%, PayPal (PYPL) -49.68% , Meta (FB US) -40.41%

We often denote this group as the ‘tech sector’ however it’s important to highlight the huge variance in the performance of the newer players versus the more established global technology brands.

- Apple (AAPL US) -10.34%, Amazon (AMZN US) -7.63%, Microsoft (MSFT US) -14.85%, Intel (INTC US) -6.58%,

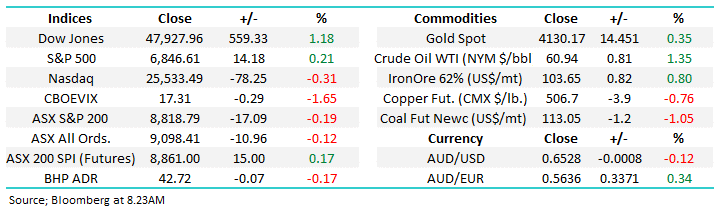

Overnight, US stocks were choppy with a 35% drop in Netflix and weakness in other related stocks pushing the Nasdaq lower while the Dow Jones added 250 points. SPI Futures imply a positive start to trade locally up 30 points with banks likely to offset weakness amongst the materials, BHP down 1.2% in the US. If IT can brush off the Netflix hangover the sector will enjoy an overnight decline in bond yields.