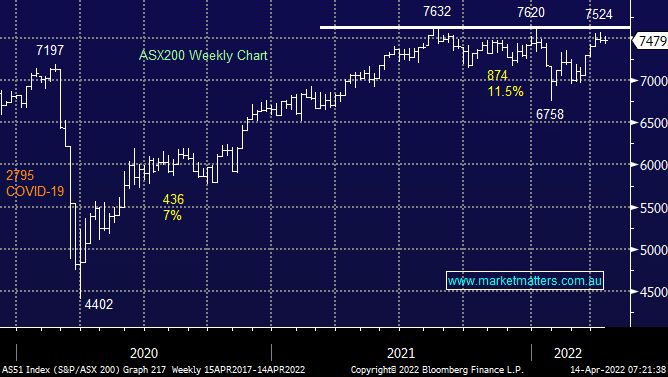

Since hitting a high of 7573 on the 5th of April, the ASX200 has drifted lower as it consolidates the gains achieved in the best March since 2009. The patience of the bulls is being tested however in MM’s view it remains just a matter of time before new highs are achieved for local stocks. Bond yields had a rest yesterday which relieved some pressure on sectors that cower at their ongoing advance while the resources & energy stocks continued to enjoy strength in their underlying commodity prices.

The list of challenges facing the market remains a long one and this week’s Bank of America survey certainly showed as much. Fund managers are very pessimistic about the growth outlook, they’re bearish on equities, although marginally less bearish than they were, and think a recession in the US is very much on the cards. This bearish view is reflected in bearish positioning which essentially means professional managers are underweight stocks. When the consensus is positioned a certain way, the surprises often happen in the other direction, a simple concept of – who’s left to sell!

At MM we think this positioning will be one of the catalysts to see markets higher in the short term and given how the market has shrugged off the likes of COVID outbreaks hitting Chinese growth, soaring bond yields, and a surging oil price, I “wouldn’t be short for quids” here.

Overnight US stocks had a solid session with tech leading the advance up over 2%. Airlines & other tourism-related stocks did particularly well following a solid update from American Airlines (AAL US). Locally the SPI futures are calling the ASX200 to open up ~20 points with the market once again testing 7500 ahead of the four-day break.

NB: An afternoon report will be sent today and normal reports will recommence on Tuesday morning, 19th of April with the Q&A report included (some questions will be answered on the site today).