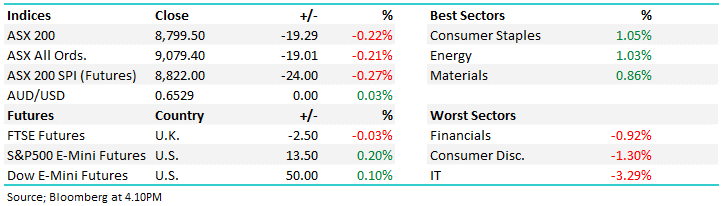

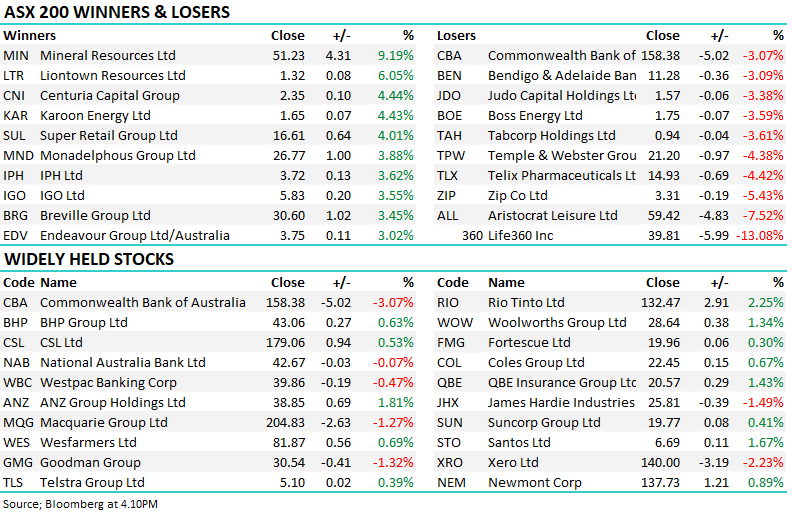

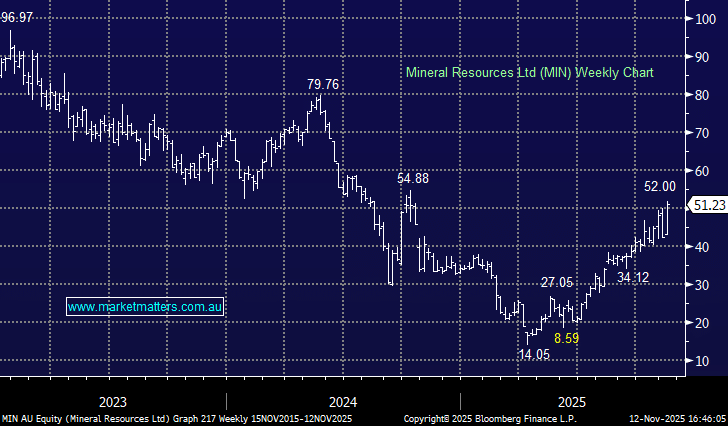

A tepid start to the trading week locally with a small 0.10% gain at the index level courtesy of strength amongst the financial stocks which have enjoyed the onset of higher interest rates, the hope that margin pressure will ease along with some large looming dividends is a hard 1-2 combo to pass up. All the talk this year has been about how hot the Energy & Materials stocks have been and rightly so, however, it’s the boring/defensive sector of Ulilities that has been the quiet achiever. In a little over 3 months, the sector that comprises the likes of APA Group (APA), Origin Energy (ORG) & AGL Energy (AGL) is up over 17%, dramatically outperforming last year’s ‘go-to’ tech sector by more than 35%. As we often say at Market Matters, keep an open mind and 2022 is so far delivering on that call.

Australian bond yields continued their upward march with the Aussie 10-years trading above 3% for the first time since July 2015, a time when the official cash rate was at 2%. To put the dramatic change in macro backdrop into perspective they were trading around 1% only 6-months ago! We would be very surprised if 3% does not cap this advance, or at least slow the momentum in the short term ahead of local inflation data out at the end of the month. In hindsight, we’ve been looking for a top in bond yields for too long however I doubt we’re alone in being surprised at how aggressively the move has unfolded, there are many bond desks around the city licking their wounds after a once in a lifetime quarter. While we think yields are overextended, we still believe this is an end to the multi-decade bull market for bonds/bear market for yields and we all need to get used to rates rising again, a foreign feeling for many.

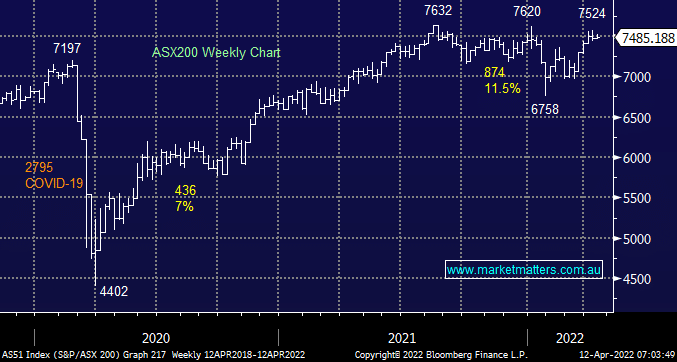

We’re now 11 days into the 2nd strongest month of the year and so far the index is little changed – what gives? We’ve just finished the most bullish March since 2009 and so far equities have consolidated rather than rallied. While subscribers will appreciate our bullish stance based on statistical trends, some consolidation of the ~7% rally by equities last month should not come as a total surprise, and it remains a bullish setup for now.

Overnight we saw US stocks decline in a broad-based sell-off, the tech sector hardest hit however all sectors of the S&P 500 finished lower. Bond yields were higher again, the US 10-year through 2.75% ahead of a very important CPI release tonight with the market expecting US inflation to hit 8.4% for March up from 7.9% annualised in February.

The SPI Futures are calling the ASX200 to fall 20-points this morning with BHP Group (BHP) down over 2% in the US.