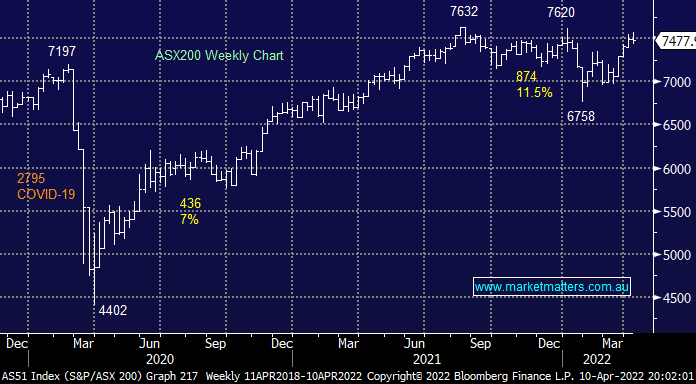

Last week saw the ASX200 consolidate its recent rally just below all-time highs despite the growing chorus for the RBA to act sooner rather than later and commence the inevitable interest rate tightening cycle, joining the US & Canada who raised by 0.25% in March and New Zealand who have now pushed through three rate increases taking the official cash rate to 1%. When the RBA cut rates way back in November of 2020 to the emergency setting of just 0.10% they based their decision on economic forecasts. By the end of 2022 they thought unemployment would be 6% and inflation would be 1.5%, as it stands now we have unemployment at 4% and inflation at 3.5%, a long way from these economic assumptions.

It seems in Australia that there is a fear that rate hikes will lead to house price armageddon & an inevitable stock market correction, or worse still, that a rate hike just before an election will be the deciding factor! However, that is generally not the case – rate hikes are a sign of economic strength, and the first part of a rate hike cycle is generally no handbrake on the market, it’s only if/when rates rise too far that markets start to become concerned.

- MM believes that Australian interest rates are too low, and the RBA should act sooner rather than later.

Higher rates are generally positive for some sectors with the banks the obvious beneficiary due to improving margins as long as bad debts remain under control, however, the trajectory of the yield curve is also very important. When the 2-year yield rises above the 10-year yield it’s known as yield curve inversion and it’s meant to signal a looming recession. The thinking here is fairly simple, financial conditions are tightening in the short term and the economy may not be strong enough to handle it leading to hardship in the longer term.

At MM, we’re not convinced it will be the case this time around due to the enormity of intervention in bond markets in recent years, however, it’s the broader shape of the curve we focus most on. A flattening yield curve is not good news for banks that essentially borrow short and lend long and as Commonwealth Bank (CBA) is approaching $110 that will be in our minds. Other areas however benefit from a flattening curve and these are best described as long duration assets. A long-duration asset could be described as one that is investing now to generate strong earnings down the track and these tend to be more heavily influenced by longer-term rates. The flattening of the yield curve implies longer-term interest rates have peaked and we should now see a tailwind, or at least less of a headwind, for these types of stocks like Technology & Healthcare, areas of the market that have recently been struggling.

- MM believes the yield curve will stay flat through 2022/23.

- We think the Australian banks are poised to struggle after advancing strongly post COVID e.g. CBA has more than doubled while also paying some very healthy fully franked dividends.

- On the other side of the coin, we believe long duration stocks in the Technology and Healthcare sectors are oversold and recent weakness can be bought.

- While MM can see the likes of both BHP & CBA making fresh highs this month, we can see ourselves fading such an advance.

Overall, we remain bullish as the market tracks towards all-time highs, believing that the ~7700/78 is only a matter of time, however, if achieved expect risk reduction across the MM portfolios.